On 1 January Year 1, Company B sets up an arrangement in which the employees receive share options, subject to a four-year service condition. The total number of options will be allocated to employees who started service on or before 1 January Year 1.

Significant subjective factors are involved in determining the number of instruments allocated to each individual employee and B concludes that grant date should be postponed until the outcome of the subjective evaluations is known in April Year 2 — i. Because the subjective factors are determined only in April Year 2, grant date cannot be before this date.

However, in this case there is a clearly defined performance period, commencing on 1 January Year 1, which indicates that the employees have begun rendering their services before grant date. Accordingly, B recognises the cost of the services received from the date on which service commences — i. The estimate used in the Year 1 financial statements is based on an estimate of the fair value, assuming that grant date is 31 December Year 1. This estimate will be revised in April Year 2 when the fair value at grant date is determined. Assume that B estimates on 31 December Year 1 that the grant-date fair value of an equity instrument granted will be 10 and the actual fair value on grant date of April Year 2 is 9.

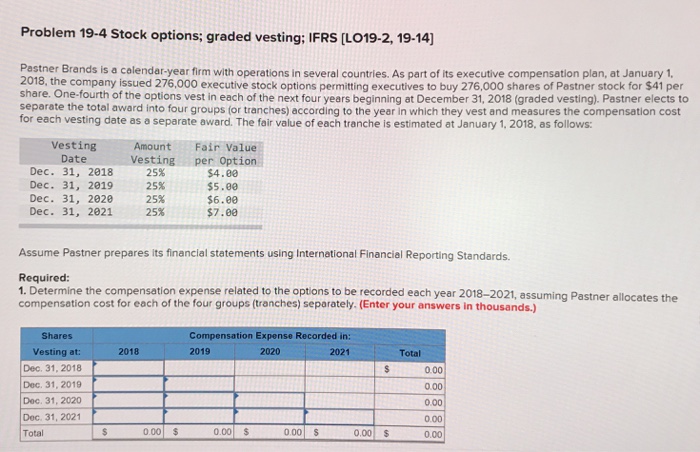

Based on preliminary profit figures, B further estimates at 31 December Year 1 that the total number of equity instruments granted will be , which is confirmed by the final profit figure. If all instruments are expected to and actually do vest, then the accounting is as follows. Notes 1. In some situations, the equity instruments granted vest in instalments over the specified vesting period. Assuming that the only vesting condition is service from grant date to the vesting date of each tranche, each instalment is accounted for as a separate share-based payment.

As a result, even though all grants are measured at the same grant date, there will be several fair values and the total cost recognised each year will be different because both the grant-date fair values and the vesting periods are different. In our experience, instalments are not always on a yearly basis, but can also be on a monthly or even daily basis, which creates significantly more data complexities IFRS 2 IG Application of the graded vesting method to grants that vest in instalments results in recognition of a higher proportion of cost in the early years of the overall plan.

This is because Year 1 would bear the full cost for the instalment vesting in Year 1 and a proportion of the cost of the instalment vesting over the next number of years — e. On 1 January Year 1, Company C grants share options to employees, subject to a four-year service condition.

- b2b forex sales.

- best strategies for intraday trading in india;

- forex trading web template.

- What Is IFRS 2?.

Once the share options vest, they can be exercised in the following two months. The exercise price equals the share price at grant date. The fair values of the equity instruments granted differ due to their different option terms and are estimated as follows. Assuming that C expects all employees to remain employed with C and that they ultimately do, the cost recognised for each of the share-based payment tranches in each period is determined as follows.

Account Options

When allocating the cost of share-based payment awards that require the achievement of both service and performance conditions, in our view no greater significance should generally be placed on either the service or the performance condition; and the share-based payment cost should be recognised on a straight-line basis over the vesting period. Company S issues to its employees share options that vest on the achievement of an EPS target after one year. In addition, the employees are required to remain employed with S for another three years after the EPS target is achieved. In general, S should recognise the share-based payment cost on a straight-line basis over the four-year period in the absence of compelling evidence that a different recognition pattern is appropriate.

Commonly, even if a grant is subject to a four-year service condition and a challenging one-year performance condition, both beginning at the same time, this is not sufficiently compelling evidence to apply a method other than the straight-line method over four years.

DIRTT provides US GAAP Financial Information

Company T issues to its employees a share-based payment that is subject to a four-year service condition and a one-year performance condition, both beginning at the same time. Although the performance target is challenging, in general T should recognise the grant-date fair value over four years. In some share-based payments, the length of the vesting period varies depending on when a performance condition is satisfied. In this case, the length of the expected vesting period needs to be estimated IFRS 2 15 b. Market condition with variable vesting period.

If the performance condition in such transactions is a market condition, then the length of the expected vesting period is estimated consistently with the assumptions used in estimating the grant-date fair value of the equity instruments granted. The length of the vesting period is not revised subsequently. Company U issues a share-based payment subject to the employee remaining in service until the share price achieves a certain target price at any time within the next five years.

In part two of our equity guide, we answer how does equity get diluted and work. Learn about anti-dilution protection and view an equity dilution example. See the difference between fair value and fair market value of equity when finding share prices for equity awards. Running a share plan for your employees means constant communication with your shareholders and other key stakeholders. Important guidelines for your communications can be found in the accounting View exciting new features and tools that will continue to improve workflow-driven processes and expand the system capability to create a more comprehensive and flexible offering.

In our last article, we described the three present factors that go into the Black-Scholes option pricing model. A lot hinges on the The Black-Scholes model can be confusing and maybe even overwhelming. For most privately-held companies, a major growth milestone and admitted headache is the point in time when their compiled financials are transitioned to audited financials. And while this may Going public is always an exciting albeit laborious time for any firm.

But the current renewed interest and optimism in the IPO market makes the prospect doubly enticing.

What happens if I terminate my employment before an option

And no wonder. What is stock expensing and how is it done? What is ASC ? According to Gain a better understanding of the history of Lattice Models and Black Scholes, how each model works, and what the most commonly used model is to calculate the value of equity compensation awards. What is a Forfeiture Rate? The forfeiture rate is the percentage of options that you expect to cancel in a year based on historical data.

Again, in this situation, the fair market value of the common stock would appear to be a better measure of fair value. The pronouncements contain basic requirements to disclose the: Type and scope of arrangements existing during the period. Description of the agreements settlement methods, vesting conditions, etc. Number and average exercise price of share options by category, including: Options outstanding at the beginning of the period. Options outstanding at the end of the period.

Options granted, vested, exercised and forfeited during the period. Options exercisable at the end of period. Range of exercise prices and remaining contractual life of options outstanding at the balance sheet date. Method of calculating the fair value of the transactions. Valuation methods model and input values, etc. IFRS Has less detailed and less specific disclosures.

IAS 8 - Accounting changes and errors. All rights reserved. Long Term Incentive Alternatives. This is a general summary of. Similar presentations.

Upload Log in. My presentations Profile Feedback Log out. Log in. Auth with social network: Registration Forgot your password? Download presentation. Cancel Download.