Would anyone then care to argue that Berkshire had not borne a cost for advertising, or should not be charged this cost on its books? Its opponents even enlisted Congress in the fight, pushing the case that inflated figures were in the national interest. The law fixed one problem. But corporate executives are smart and they have figured out another way to manage investors expectations.

You show profits by not counting depreciation and stock based compensation as an expense. To me this is nonsense. If stock based compensation is not an expense then what the hell are they? As long as investors are gullible, executives can paint whatever investors want to see.

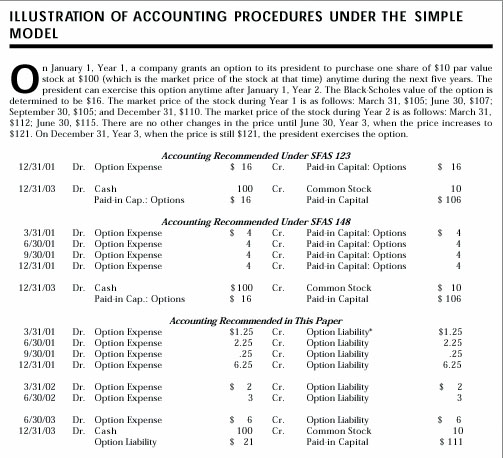

Do fish really take these lures? I learned these concepts by reading the book shown below. Also I took the Financial Accounting course from coursera. I would highly recommend this course for anyone who wants to know how the financial statements are put together. I believe options were granted.

I assume its a narrative error. For 1 that was a terrible mistake from my part. I fixed it and let me know if you still find issues. Thanks a lot for pointing this out. Since this happens in the future and there is a likelihood of this not happening. Does stock based compensation and employee benefit stock plan line item in equity statement always refer to restricted stocks?

So to start with you increase Common stock and APIC and also the contra liability account so the net effect is zero. Over the vesting period you reduce the contra liability account and replace it with compensation expense. Thanks for your explanation. I understand that the compensation expense is charged to the income statement over the vesting period and the deferred compensation expense is reduced to zero.

- How Do You Book Stock Compensation Expense Journal Entry? – FloQast.

- forex play money?

- curso 7 pasos forex.

- Conclusion.

- Fallacy 1: Stock Options Do Not Represent a Real Cost?

- Kezar Life Sciences, Inc. Quarterly report pursuant to Section 13 or 15(d)?

Please check if my entries below are correct. So, deferred compensation expense asset gets amoritzed over vesting period and APIC and Common stock stays on the balance sheet. Your entries for Mar is correct.

stock options outstanding in balance sheet

For the next two years, common stock and APIC will not get touched at all. Instead deferred compensation expense goes down to zero and compensation expense takes its place which in turn reduces retained earnings. Thanks Jana for the post.

Do you think a credit investor should also be worried about stock expense accounting. Cash flows do not change materially, so why bother? I mean only an equity investor who cares for the EPS number and potential equity dilution should be concerned. As we are having discussion on stock compensation, i thought it would be timely to provide the following example of stock compensation abuse by technology corporations. Based on the following information from footnotes, You will find this trend in most of the technology companies. But would be happy to hear. Divide revenue, operating income, cash flows by total shares outstanding.

So if the share count is going up then you will be able to adjust for it. You will like what Michael Shearn is telling. Thanks for your article! What is your view on that stock based compensation are added to the operating cash flow of companies and thereby having a positive effect on free cash flow? Jana — another great post thanks for sharing. Could you confirm that as of Net Income is reduced by annual option expense? If that is true then should we still use Diluted Shares to calculate per share values?

Last thought — I believe we should take the present Fair Value of remaining unexercised options, on a per share basis, and reduce our final intrinsic value of the firm by that amount. If they do not then the investor should reduce Net Income by that amount reported in the Notes themselves. Reduce your intrinsic value of the firm by this amount. Check the trend of shares outstanding over the past years.

Accounting for Employee Stock Option Plan [ESOP]

If the management dilutes a lot, a pattern you will see in technology companies, then you need to ask if you want to partner with the management. If yes then take the diluted shares outstanding to simplify things. I have one question. I increased my common stock and APIC now how to present that in the balance sheet and statement or equity. Thanks Ali. Is stock compensation really an expense?

Like this: Like Loading Related posts. As always, Thanks! Thanks Jana for your post. I have a couple of queries related to the example for stock options: 1 Why did you expense compensation for stock options? Thanks much, Gaurav.

Hi Gaurav, For 1 that was a terrible mistake from my part. Regards, Jana. Hi Jana, Thanks again for one more excellent post. I have few questions on this topic. Your reply will be appreciated Thanks Balaji. Hi Balaji, Thanks for your comments. Thanks, Balaji.

BUSINESS IDEAS

Hi Balaji, Deferred compensation expense is not an asset. During the whole process nothing happens to the asset side of the balance sheet. Hello Everyone, As we are having discussion on stock compensation, i thought it would be timely to provide the following example of stock compensation abuse by technology corporations. Balaji, You will find this trend in most of the technology companies. Can you please explain?

Hi Balaji, Divide revenue, operating income, cash flows by total shares outstanding. Hi Jana, Thanks for your article! I remove that for calculating cash flow from operations. David, Check the trend of shares outstanding over the past years. Options embedded in complex securities such as convertible debt, preferred stock, or callable debt like mortgages with prepay features or interest rate caps and floors.

A whole subindustry has developed to help individuals, companies, and money market managers buy and sell these complex securities. Current financial technology certainly permits firms to incorporate all the features of employee stock options into a pricing model. But financial statements should strive to be approximately right in reflecting economic reality rather than precisely wrong.

Managers routinely rely on estimates for important cost items, such as the depreciation of plant and equipment and provisions against contingent liabilities, such as future environmental cleanups and settlements from product liability suits and other litigation. Not all the objections to using Black-Scholes and other option valuation models are based on difficulties in estimating the cost of options granted. Since almost all individuals are risk averse, we can expect employees to place substantially less value on their stock option package than other, better-diversified, investors would.