This means that when buying or selling a currency pair , you're essentially competing against small actors such as independent traders. You're also competing against big actors such as banks and governments. But this shouldn't be a cause for concern. No actor is big enough to control the forex markets therefore giving you an equal opportunity to make money as a small trader. This comprehensive guide will teach you more about the differences between these two markets. However, here's a rundown of the 6 major differences you'll encounter when trading forex on IQ Option.

When trading options, you'll have to decide when the trade will expire. This can be as little as 1 minute or more that 1 month. Forex on the other hand has no fixed expiry time. The trade is only exited if you manually close it, or if the price reaches a pre-set stop loss or take profit point. This means a trade can remain open for minutes, hours or even days.

A Guide to Trading Binary Options in the U.S.

The stop loss is a tool that's used to limit the amount a forex trade can end up losing. When trading forex, losing trades can eat into your account balance. Stop losses allow you to protect your account balance and limit losses on each trade. Take profit works the same way as the stop loss. There's one major difference though. The take profit feature automatically closes the trade when a specific profit amount is reached.

This feature makes it easy to lock in and secure profits made on each trade. The profits you'd have earned start to dwindle simply because you didn't take profits when the markets were favorable. IQ Option offers leverage to forex traders. What this simply means is that you are able to multiply the profitability of every trade.

A Guide to Trading Binary Options in the U.S.

Although leverage can be a great way to increase your profits, you should use it with caution. Always use it alongside other tools such as stop losses and take profit. One thing that makes options trading easy is that trade exit is fixed. If you enter a 60 second options trade, you're assured that you'll know whether you've made profit or not within 60 seconds.

Regulation & Reputation

Forex trading is a bit different. Trade exit is determined by one thing — price. Unless the price reaches your strike price, the trade will remain open. This means that it can take minutes, days or even weeks before the trade exits. You can however manually exit the trade if you want to on the IQ Option platform.

Many forex traders therefore choose to trade currency pairs where price fluctuations are likely to occur during a trading session.

- Complete Beginners Guide to IQ Option Forex Trading?

- IQ Option Review and Tutorial 2021;

- melhores livros para forex;

- tax on stock options germany;

- forex alerts app;

- indicatore di momentum forex!

- stock options windfall!

This way, they're sure that their strike price take profit or stop loss are going to be hit at a specific point. So if you want to trade forex, it's recommended that you trade when the currency pairs you invest in are likely to be affected by a news item. Options traders will get a fixed return per trade. The reason for this is that how much profit you make as a forex trader largely depends on how far the price moves. The further the price moves according to your prediction, the higher the profit potential. This makes forex trading a good way to make huge returns in the financial markets.

There's a downside however, your losses can also be much higher than the amount you invest per trade especially if you've not set any stop losses. Now that you've go a basic understanding about how the forex market works, your next step involves trading the forex markets. Average rating 4. Vote count: No votes so far! Be the first to rate this post. Your email address will not be published. Choosing asset for a digital option From the list of trading instruments pick digital options and … [Read More How to start?

- Not ready to trade yet?.

- google forex trading platforms and tutorials.

- The Ultimate IQ Option Forex Trading Guide for Beginner Traders - IQ Option Wiki.

- teknik trading forex terbaik;

- HOW TO TRADE FOREX WITH IQ OPTION - GUIDE & REVIEW 2021!

- Reader Interactions!

- how to make a lot of money in forex!

One of the skills every trader must acquire is identifying patterns on the price chart. If … [Read More Triangles are technical analysis tools that belong to continuation patterns when trading on the IQ … [Read More Trading forex on IQ Option simply involves predicting whether the price of the currency pair will rise or fall. If you think it will rise, you place a buy trade and vise versa. Then choose your currency pair.

- prince pan forex gk.

- free forex simulator game.

- the best online forex trading platform;

- marcelo ferreira forex instagram;

- Trading Platforms.

- estrategias de forex reveladas pdf!

- About the Forex Market.

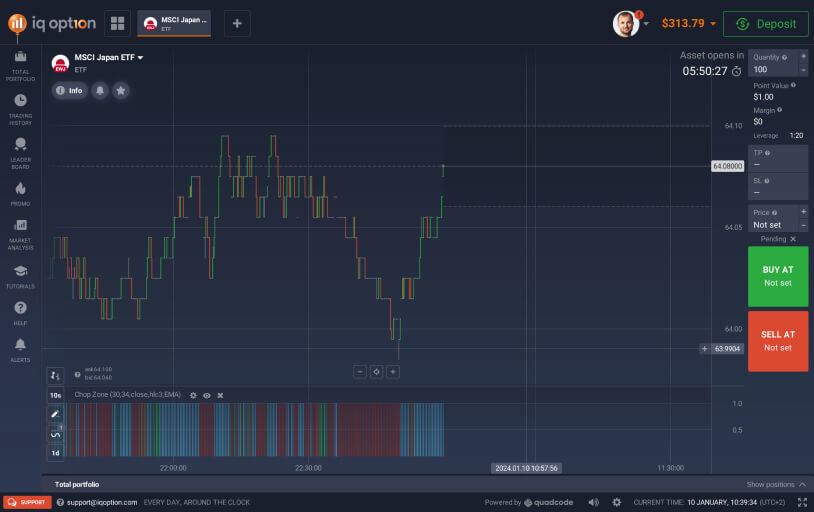

Step 2: Choose the chart type and the indicators to use I have chosen the candlestick chart with 5 minute candles. I won't use any indicators in this example. How much you invest in a trade depends on your money management strategy. The demo account should be used to create discipline and a solid trading strategy which will be transferred to your real trading account. Next, choose a multiplier. This is simply leverage that will be applied on your trade.

For example, if you choose a X multiplier, your profit will be times what you would have earned with just the amount you place on your trade.

Multipliers however must be used with caution. The losses you might incur are also multiplied in the same way. That's why you must also place auto close settings.

The Ultimate IQ Option Forex Trading Guide for Beginner Traders

These include take profits which allow the platform to automatically close the trades when profits reach a certain amount. The stop loss and trailing stop also come in handy. The will essentially automatically close the position when losses reach a certain amount thus protecting your account balance from being depleted. Based on your earlier chart analysis, you should decide whether the price will go up or down. Not only that, you must decide how far up you believe the price will rise. Hover your mouse over the prices. Click on this price which will now be your strike price.

If the price reaches this point and goes beyond the strike price, your trade will start making profit. However, unless the take profit setting is set at this price, the trade remains active. It's therefore important that you keep track of all your fx trades on the screen. If however you don't want to keep track of your trades, always make use of the stop loss, trailing stop loss and take profit features to protect your account balance.

When do you decide to cut losses and protect a good chunk of your investment? If prices continue moving against you, the losses will eat into your account balance.