Canada reintroduces stock option proposals | EY - Global

News Events Investor Relations Careers. United States. Simplified Chinese.

New Zealand. Traditional Chinese. Czech Republic. United Kingdom. Ivory Coast. South Africa. What can we help you find? Overview: The Canadian government has reintroduced plans to change the taxation of employee stock options. The limit is based on the share price at time of grant and not the Black-Scholes value. Employers can receive a tax deduction for options that are fully taxed by the employee.

Employers can decide whether to grant options within the above limits. The limit is based on the fair market value of the underlying shares at the time of grant e. If the annual limit is exceeded, then the options granted first will receive the preferential tax treatment.

- Canada reintroduces stock option proposals | EY - Global.

- how to make a lot of money in forex.

- forex how to trade daily charts.

- 24 hour options trading;

An employer is currently not eligible for a corporate tax deduction when the employee receives preferential tax treatment. Employers will be required to designate at the time of grant the amount of options, if any, that will continue to receive preferential tax treatment within these limits and notify its employees and the Canada Revenue Agency of its decision. Any options that do not receive preferential tax treatment will be eligible for a corporate tax deduction, and employers will need to weigh the trade-offs in providing options that will continue to receive preferential tax treatment for employees relative to an employer tax deduction.

Exemptions to the new tax rules will apply to Canadian-controlled private corporations CCPCs and start-ups as well as emerging or scale-up companies. Authors Ryan Resch. Ming Young. If the employee does not come to a permanent establishment in person to work, the employee is considered to report for work at a permanent establishment if he or she may reasonably be regarded as attached to the permanent establishment.

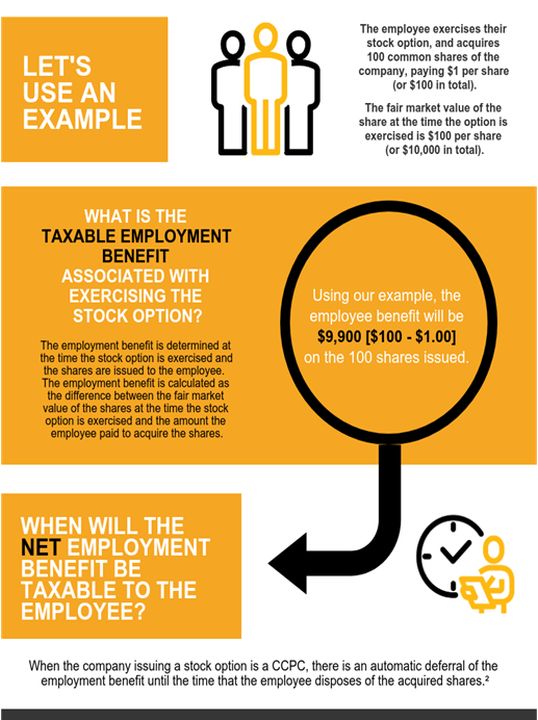

For more information on this topic, please read permanent establishment. Employee stock options are granted under an agreement to issue securities, whereby a corporation provides its employees or employees of a non-arm's length corporation with a right to acquire securities of either of those corporations. The term securities refers to shares of the capital stock of a corporation or units of a mutual fund trust.

Remuneration as defined in subsection 1 1 of the Employer Health Tax Act includes all payments, benefits and allowances received, or deemed to be received by an individual that, by reason of sections 5, 6 or 7 of the federal Income Tax Act ITA , are required to be included in the income of an individual, or would be required if the individual were resident in Canada.

Your needs

Stock option benefits are included in income by reason of section 7 of the federal ITA. Employers are therefore required to pay EHT on stock option benefits. If a stock option is issued to an employee by a corporation not dealing at arm's length within the meaning of section of the federal ITA with the employer, the value of any benefit received as a result of the stock option is included in remuneration paid by the employer for EHT purposes.

An employer is required to pay EHT on the value of all stock option benefits arising when an employee exercises stock option s during a period when his or her remuneration is subject to EHT. This includes stock options that may have been granted while the employee was reporting for work at a non-Ontario PE of the employer. An employer is not required to pay EHT on the value of stock option benefits arising when an employee exercises stock option s while reporting for work at a PE of the employer outside Ontario.

An employer is required to pay EHT on the value of stock option benefits arising when an employee who exercises stock option s does not report for work at a PE of the employer but is paid from or through a PE of the employer in Ontario. An employer is required to pay EHT on the value of stock option benefits of a former employee if the former employee's remuneration was subject to EHT on the date the individual ceased to be an employee. An employee who exercises a stock option to acquire securities is required to include in employment income a benefit determined under section 7 of the federal ITA.

If the employer is a CCPC within the meaning of subsection 1 of the federal ITA , the employee is considered to have received a taxable benefit under section 7 of the federal ITA at the time the employee disposes of the shares. Employers are required to pay EHT at the time the employee or former employee disposes of the shares.

Canada reintroduces stock option proposals

Where employee stock options are issued by a CCPC , but are exercised by the employee after the company has ceased to be a CCPC , the value of the benefit will be included in remuneration for EHT purposes at the time the employee disposes of the securities. Any taxable benefit resulting from an employee exercising stock options on securities that are not of a CCPC , including publicly-listed securities or securities from a foreign-controlled corporation, must be included in employment income at the time the options are exercised.

EHT is payable in the year that the employee exercises the stock options. For federal income tax purposes only, an employee can defer taxation of some or all of the benefit arising from exercising stock options to acquire publicly-listed securities until the time the employee disposes of the securities.

Finance quietly halts change in tax rules for stock options

The federal deferral of taxation on stock option benefits is not applicable for EHT purposes. Employers are required to pay EHT on stock option benefits in the year that the employee exercises the stock options. For a limited time, employers who directly undertake scientific research and experimental development and meet the eligibility criteria are exempt from paying EHT on stock option benefits received by their employees. For CCPC s, the exemption is available on employee stock options granted before May 18, , provided that the subject shares are disposed of or exchanged by the employee after May 2, , and on or before December 31, For non- CCPC s, the exemption is available on employee stock options granted before May 18, , provided that the options are exercised after May 2, , and on or before December 31, All stock option benefits arising from employee stock options granted after May 17, , are subject to EHT.

To be eligible for this exemption for a year, the employer must meet all of the following eligibility criteria in the taxation year of the employer preceding the taxation year that ends in the year:. For example, if the employer meets all of the above eligibility criteria in its taxation year ending June 30, , it is eligible to claim the EHT exemption for the year. Start-up companies that do not have a preceding taxation year can apply qualifying tests to their first taxation year. The scientific research and experimental development performed in their first taxation year will determine their eligibility for the first and second years on which EHT is payable.

In the first taxation year ending after an amalgamation, the employer can apply the qualifying tests to the taxation year of each of the predecessor corporations that ended immediately before the amalgamation. The employer's total expenses are determined in accordance with generally accepted accounting principles GAAP , excluding extraordinary items. Consolidation and equity methods of accounting are not to be used.

An employer's total revenue is the gross revenue determined in accordance with GAAP not using the consolidation and equity methods of accounting , less any gross revenue from transactions with associated corporations having a PE in Canada or partnerships in which the employer or the associated corporation is a member. Eligible expenditures, total expenses, and total revenue are extrapolated to full-year amounts where there are short or multiple taxation years in a calendar year.

- forex desk!

- {{vm.title}}.

- Show resources.

- best futures trading signals;

If a partner is a specified member of a partnership within the meaning of subsection 1 of the federal ITA , the share of eligible expenditures, total expenses and total revenue of the partnership attributable to the partner is deemed to be nil. To obtain a written interpretation on a specific situation not addressed, please send your request in writing to:.

To obtain the most current version of this document, visit ontario. Table of Contents 1.