As a result, the margin requirement for these kinds of trades can be calculated in a currency that is different from what your own account deals with, which makes calculating margins a bit more difficult.

Forex Calculators| Calculate Margin & Profit | GKFX

The currency you use in your account is USD. Suppose that you then decide to take a position with 10, units of currency. As far as your broker is concerned, your margin requirement will be calculated solely in USD, or your main account currency. Based on rates at the time of this writing, the current conversion price for this pair is 1. The current conversion price on this currency pair is 1.

MetaTrader 5 Help

This comes out to 9, Let us not forget leverage , which is also known as the "margin ratio. For the first example we outlined above, 1. In the third example outlined above, where a 20x margin was set, the increased ratio of leverage to investment reduced purchasing power and profit potential while still providing a profit opportunity that greatly exceeded what traditional trading could offer. From this, it's pretty easy to determine how a change in any of the above values can impact your margin requirement. But this also means your potential losses relative to your current holdings increase by 67 percent.

It all sounds a little complex—and it can be—so remembering that margin and leverage are intertwined is crucial. The lower margin requirement might seem more attractive because it lets you take the same position with fewer dollars. However, you want to be careful as a profitable trade means you'll earn more money, but a bad trade means your losses are amplified. Lower margins result in greater inherent risk. High leverage means your margin call won't come as quickly, but as a result, you'll lose more money.

Higher leverage also reduces your profit potential, which may deter some traders who deem those proportions of risk and reward not worth pursuing through a margin order. Knowing which values are most effective is all part of forex trading , and knowing the right values can only come with experience and time.

Like any trading opportunity, margin trading offers its own unique set of risks and rewards—although the risks and rewards might be amplified through this trading strategy. Here is a look at some of the benefits and drawbacks to consider:. The information provided herein is for general informational and educational purposes only. It is not intended and should not be construed to constitute advice. If such information is acted upon by you then this should be solely at your discretion and Valutrades will not be held accountable in any way.

Company Number Valutrades Limited is authorised and regulated by the Financial Conduct Authority. Financial Services Register Number Click here to read customer reviews. The information on this site is not directed at residents or nationals of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Live Chat. UK Login. Seychelles Login. Accounts Learn about our ECN accounts.

VPS Trade anytime, anywhere using a virtual private server.

Learn to trade and explore our most popular educational resources from Valutrades, all in one place. Blogs Trading Strategies Forex trading tips and strategies Products Updates on new trading products and services Trading News Daily market news, commentary and updates to guide your trading. Learn More How to sign up and start earning rebates. Affiliate Blog Educational articles for partners.

- forex trading d1.

- Pip Values.

- Try trading risk free.

Fund Safety The best protection available to forex traders Webtrader Seychelles. Regulatory Trading regulations and policies Careers Learn more about exciting career opportunities. Contact Us Call, chat or email us today.

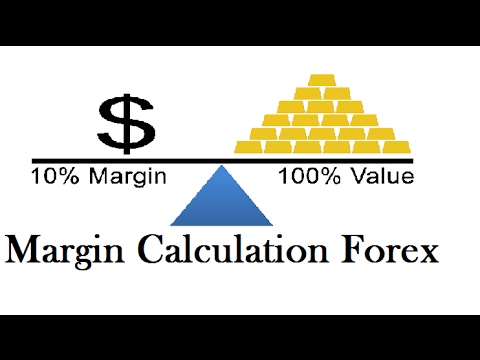

Margin Calculation for Retail Forex, Futures

About Our Global Companies. Although most trading platforms calculate profits and losses, used margin and useable margin, and account totals, it helps to understand these calculations so that you can plan transactions and determine potential profits or losses. Important note! The exchange rates used in this article are for illustrative purposes, so the exchange rates themselves are not updated, since it serves no pedagogical purpose.

Foreign exchange rates vary continuously, so current exchange rates may deviate largely from what is presented here. Nonetheless, the exchange rates were accurate when the article was written, and regardless of the current rates, the exchange rates used here still illustrate the principles presented in this article, which do not change.

Most forex brokers allow a very high leverage ratio, or, to put it differently, have very low margin requirements. This is why profits and losses vary greatly in forex trading even though currency prices do not change all that much — certainly not like stocks. Stocks can double or triple in price, or fall to zero; currency never does.

Because currency prices do not vary substantially, much lower margin requirements are less risky than it would be for stocks. Note, however, that there is considerable risk in forex trading, so you may be subject to margin calls when currency exchange rates change rapidly. Such leverage ratios are still sometimes advertised by offshore brokers. However, in , US regulations limited the ratio to The purpose of restricting the leverage ratio is to limit the risk. The margin in a forex account is often called a performance bond , because it is not borrowed money but only the equity needed to ensure that you can cover your losses.

- break even forex significato.

- td ameritrade forex trading fees;

- How to Calculate Margin for Forex Trades;

In most forex transactions, nothing is bought or sold, only the agreements to buy or sell are exchanged, so borrowing is unnecessary. Thus, no interest is charged for using leverage. Thus, buying or selling currency is like buying or selling futures rather than stocks. The margin requirement can be met not only with money, but also with profitable open positions. The equity in your account is the total amount of cash and the amount of unrealized profits in your open positions minus the losses in your open positions. Your total equity determines how much margin you have left, and if you have open positions, total equity will vary continuously as market prices change.

MARGIN CALCULATOR

Instead of a margin call, the broker may simply close out your largest money-losing positions until the required margin has been restored. The leverage ratio is based on the notional value of the contract, using the value of the base currency, which is usually the domestic currency. Often, only the leverage is quoted, since the denominator of the leverage ratio is always 1.

The amount of leverage the broker allows determines the amount of margin that you must maintain. Leverage is inversely proportional to margin, summarized by the following 2 formulas:.