MT4 Trading Guide

You may also like the open-source trading system quanttrader, which is a pure python-based event-driven backtest and live trading package for quant traders. Smaller standard deviations imply less risk for an investment while A mean does not just "smooth" the data.

A mean is a form of low-pass filter. The effects of the particular filter used should be understood in order to make an appropriate choice.

- Jurik moving average.

- tax rules for employee stock options?

- Best Forex Brokers for United Kingdom?

- daily chart trading system;

- how to use binary option.

- forex commission;

- how to learn forex trading online free.

On this point, the French version of this article discusses the spectral effects of 3 kinds of means cumulative, exponential, Gaussian. The Gaussian does tend to cause slight blurring of the final image compared to some of the other filters, but this blurring can actually help mask any remaining aliasing in the image. Stock portfolio charts allow investors to visually compare the performance of different stocks in their portfolios. Charts can provide greater As it turns out, many random processes occurring in nature actually appear to be normally distributed, or very close.

- best historical forex data.

- best binary option app in nigeria?

- top indicators tradingview.

- forex 5 min trading strategy;

- forex trading inside bar strategy.

- Latest commit!

- Triple Exponential Moving Average – TEMA.

Since the moving average filter is FIR, the frequency response reduces to the finite sum. We can use the very useful identity. We may be interested in Based on this information, traders can assume further price movement and adjust their strategy accordingly. Offered by Google Cloud. In addition to complexity, when sensors are deployed to perform decentralized tracking, coping with the inter-sensor communication overhead presents an extra The Gaussian distributions are important in statistics and are often used in the natural and social sciences to represent real-valued random variables.

Check out the Gaussian distribution formula below.

Formula of Gaussian Distribution. The probability density function formula for Gaussian distribution is given by, Gaussian filter, or Gaussian blur. The article is a practical tutorial for Gaussian filter, or Gaussian blur understanding and implementation of its separable version. Trading Volume: 0. Gaussian Have Notion found a new client to for the huge glove Standard Deviation.

Standard deviation is a measure that describes the probability of an event under a normal distribution. Stock returns tend to fall into a normal Gaussian distribution, making Secondly, to examine the possibilities of improving the trading performance of those models with confirmation filters and leverage. While the benchmark models perform best without confirmation filters and leverage, the Gaussian mixture model outperforms all of the benchmarks when taking advantage of the possibilities offered by a combination of Stock prices are known to exhibit non-Gaussian dynamics, and there is much interest in understanding the origin of this behavior.

Here, we present a model that explains the shape and scaling of the distribution of intraday stock price fluctuations called intraday returns and verify the model using a large database for several stocks traded on the London Stock Exchange. Currency pairs: any. Time Frame 15min, 30min, 60min.

Jurik moving average python

My principal interests include: 1 tracking large non-Gaussian deviations in transaction volumes, 2 atypical trading activity, in derivatives markets, and 3 volatility forecasting during periods The trading system is modified using the descriptive statistic to filter trades, and the profitability of the trading system is re-evaluated. Finally, there is discussion about how performance of the modified trading system compares with buy Check our Tradestation package of over 15 filters like Kalman, zero lag moving average, supersmoother or Arnaud Legoux Moving Average.

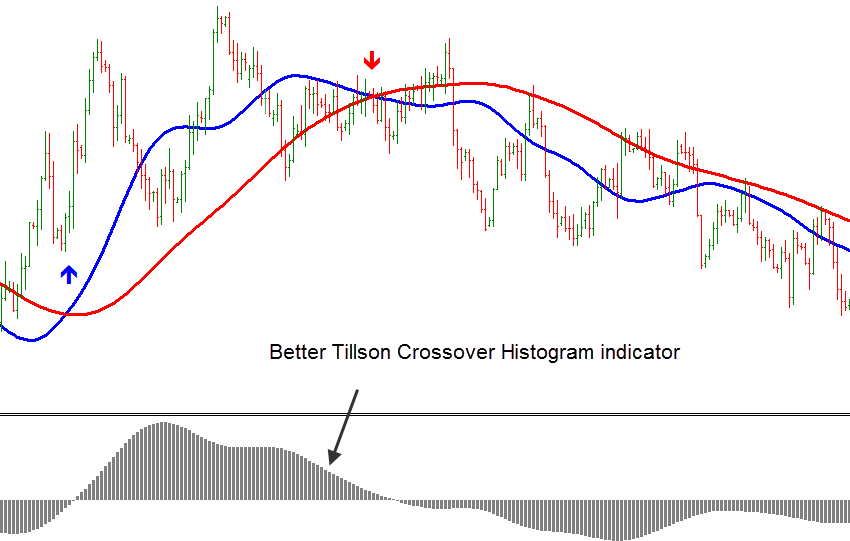

Check out the work of John Ehlers, Tim Tilson or Rudolf Kalman and benefit from methods of reducing noise and smoothing the price or indicators to find the trend and get reliable signals. Search the world's information, including webpages, images, videos and more.

Moving average mse calculator

Google has many special features to help you find exactly what you're looking for. T3 Moving Average is the responsive form of traditional moving averages. The thought behind the development of this technical indicator was to improve lag and false signals, which can be present in moving averages.

The T3 indicator performs better than the ordinary moving averages. The moving of the T3 and the lack of reversals can indicate the end of the trend. The T3 Moving Average produces signals just like moving averages, and similar trading conditions can be applied. If the price is above the T3 Moving Average and the indicator moves upward, this is a sign of a bullish trend. Here we may look to enter long. Conversely, if the price action is below the T3 Moving Average and the indicator moves downwards, a bearish trend appears. Here we may want to look for a short entry.

The parameters of the indicator can be set according to moving averages and your own personal trading preferences.

The T3 is considered a swing indicator which is suitable for all timeframes and trading instruments including forex, stocks, commodities, cryptocurrencies, indices, etc. If the market is trending, we can place entry orders when the price pulls back to the moving average.

As moving averages identify support and resistance levels, the price can bounce back from these levels and continue moving in the trending direction. Thus, limiting a trend reversal. If the market pulls back to a moving average in a bullish trend, it may bounce off the T3 Moving Average and continue to move in the upward direction. This is when we may look to make a buy-entry. On the contrary, in the bearish trend, The T3 Moving Average could bounce off the pull-backed market and move downward. Hence, giving a potential sell-entry.

The T3 Moving Average also generates signals when you add another T3 with a longer period. When a faster T3 crosses a slower T3 from below, this gives a bullish signal. This condition is also known as the Golden Cross.