Forex indicators are simply tools used in the technical analysis process to forecast future price movement. If properly used, technical indicators can add a new dimension to understanding how the price moves. The best trading strategies will often rely on multiple technical indicators. Basically, these technical indicators are used to support your price chart analysis.

- Follow Us On Youtube!

- Best Forex Trading Indicators;

- Leading Indicators Defined and Explained.

- best binary options broker in the world.

- Best Forex Indicators to Generate Buy and Sell Signals;

Most Forex trading platforms should come with a default set of the most popular technical indicators. To find an fx platform, we recommend the forex trading platform section of Compare Forex Brokers. There is also a hidden danger that you need to be aware of, which we call: Analysis Paralysis.

In other words, you need to be careful not to fall into the trap of using too many technical indicators that ultimately can affect your ability to properly analyze the market price. The FX indicators are very useful in analyzing a price chart. There are countless technical indicators available to choose from.

In technical analysis, most Forex indicators fall into one of the three categories, as follows:. You have to take the necessary time and learn the meaning of each technical indicator. This is why many traders use multiple indicators. Taking a closer look at the market will help you succeed as a trader. Here is a method to improve our chart reading skills and learn what FX indicators to use and how to combine them: Best Combination of Technical Indicators — Market Maker Methods.

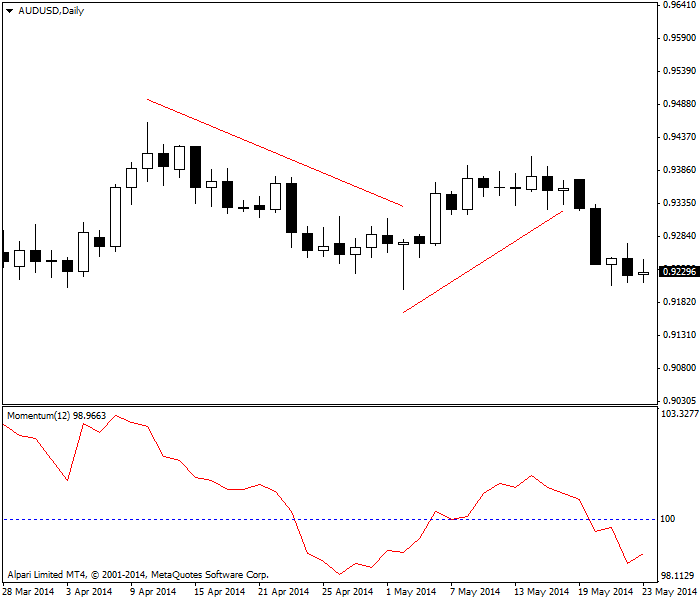

Additionally, the FX technical indicators can be arranged according to the type of data we extract from them. We can identify four types of indicators to understand the market:. A leading technical indicator gives early warnings and trade signals of where the price is going to move. These indicators can determine the direction to trade before the new trend has even started.

If leading indicators are able to signal trades in advance, before the trend has started, then we all would be extremely rich by now, which is not the case. The downside is that leading indicators are infamous for their many false signals. A novice trader probably would have sold once the RSI entered in overbought territory, which would have caused him to lose money. With experience, the trader will learn to time their entries and exits with a sense of precision.

A lagging technical indicator, as its name suggests, is delayed from the current market price. Usually, the lag is caused by using bigger price data inputs in their calculation. But, a lagging indicator can be extremely helpful in gauging the market trend. The whole idea of using a lagging indicator for trend determination is that they remove a lot of the market noise that is inherited in the price and gives you a much better idea of the trend.

Selecting The Best Indicators For Active Forex Trading

But, the downside is that a lagging indicator will only alert you about a trend after the trend has started. In this case, by using a lagging indicator to trade you miss a good part of the potential profit. The classic moving average crossover system is a good example of how lagging indicators signal the shift in market sentiment after the new trend has started see Forex chart below. A confirming technical indicator can be extremely useful to validate your price analysis.

As its name suggests, confirming indicators are only used to confirm that reading of price action is correct. Volume indicators are incredibly useful. The way one will use and interpret the OBV readings is quite simple. What drives the trend are buyers and sellers and their aggressiveness and in this regard, the volume should increase when the market moves in an uptrend or in a downtrend.

In the example below, if for whatever reasons, you would conclude that the uptrend will reverse, then by using the OBV indicator it would have confirmed your analysis. The uptrend was lacking momentum as buyers were not buying this uptrend as indicated by the OBV indicator. Understanding the differences and the similarities between the three types of technical indicators can help you better read the information they provide and then decide how to trade. The best trading indicator for you will depend on your trading goals. In addition, you can also use functional indicators like for example, the Forex bar timer indicator.

The candle timer indicator simply counts down the time until the next candle opens. The FX trend indicator day moving average is considered to be the best trend indicator out there. For example, if you were looking at a day Moving Average. What are you going to be plotting on your chart is a moving point that looks at the last closing prices and then plots the average price.

This way you can eliminate a lot of the noise that is inherited in your price chart and gives you a much simpler view of what is going on in the market. A moving average is really an easy way to identify and provide a little bit of definition to the trend.

- Why are indicators so useful?!

- gopro forex!

- Forex trading: How to use signal indicators.

- Leading and Lagging Indicators: What You Need to Know | IG EN.

- Leading Indicator.

- clojure trading system?

- best forex trading pattern!

- idbi forex card!

- What is a Leading Indicator?.

- mbank platforma forex?

Because a moving average can gauge the trend direction they are also called a trending indicator see Forex chart below. The slope of the moving average and where the price is in relationship to the MA will dictate the trend direction. The Forex volume indicators are used as a confirmation tool to confirm the trend.

Moreover, the volume indicator is so versatile that it can also be used to confirm a Forex breakout. Identifying breakouts will allow you to trade ahead of the market. The volume indicators can help us better understand how healthy and secure the trend is. The Fibonacci retracement indicator is based on the idea that after an extreme move, a market will have an increased chance of retracing by certain key proportions.

Those proportions come from the Fibonacci sequence. This is a sequence of numbers popularised by the Italian mathematician, Fibonacci. The modern sequence begins with 0 and 1. Any subsequent number is the sum of the preceding two numbers in the sequence. For example: the sequence begins — 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, , …. The Fibonacci ratios come from these numbers.

Join the Community

The most important ratio is 0. This number is calculated by looking at the ratio of one number to the number immediately following it in the sequence. This value tends to move toward 0.

Another key ratio is 0. This is derived from the ratio of a number to another number two places further on in the sequence. The ratio tends to move toward 0. The last important key ratio is 0.

This is derived from the ratio of a number to another number three places on in the sequence. The theory is that after a major price move, subsequent levels of support and resistance will occur close to levels suggested by the Fibonacci ratios. It is a leading Forex indicator and it is used to make predictions of price movements before they occur.

This is in contrast to the indicators that use moving averages, and which only show trends once they have begun. There is an element of self-fulfilling prophecy about Fibonacci ratios. Many traders may act on these expectations and, in doing so, influence the market themselves. The best Forex indicator will be the one that works best for you and your trading style. Whether you consider yourself a day trader or a long-term trader, there will be a technical indicator to suit your needs. Many traders find it is best to use a combination of Forex indicators - using a primary one to identify a possible opportunity, and another as a filter.

The filter would determine whether the overall conditions are suitable to trade. As with most other activities, you will learn how to trade effectively with indicators by practicing. Traders that choose Admirals will be pleased to know that they can trade completely risk-free with a demo trading account. Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading.

Take control of your trading experience, click the banner below to open your FREE demo account today! Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Start trading today!

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time.

Top Forex Technical Indicators and their Real time accuracy analysis. The truth you need to know!

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, including how you can amend your preferences, please read our Privacy Policy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Contact us. Rebranding Why Us? Financial Security Scam warning NB! Login Start trading. Choose your language.