Puts vs. Calls

Ally Invest is an excellent choice for a beginning options trader. The platform is user-friendly and comes with plenty of tools, including charts, data, and analytics, to help new traders understand the art of options trading. Ally Invest is geared for the beginning option trader, but experienced traders alike will also get massive value from the options trading platform. Merrill Edge is owned and operated by its parent company Bank of America, which is renowned for its high-quality customer service, delivering both educational insight and market research to help clients achieve next-level trading success.

Merrill Edge MarketPro is not as well-known of a trading platform as many others on the list, but customer satisfaction remains high, and customers are able to combine their Bank of America account with their Merrill Edge account to earn all sorts of perks through the Bank of America rewards program. This is a company that has been very popular among professional traders, but in they launched their new product, IBKR Lite, for average traders.

Interactive Brokers have always been a solid choice for professional traders doing large-volume. However, beginners might be better off by using a more handholding broker that provides additional resources and support.

Lightspeed is a lesser-known broker with a higher focus on active traders. Even though they are not as mainstream as some of the other brokers on the list, they offer a professional options trading platform called Livevol X, which provides traders with fast execution and detailed analysis. Lightspeed is not necessarily the best choice for beginning traders, where it lacks in user-friendliness; it makes up for with powerful tools.

Trade Station is a top choice for more seasoned traders. They initially launched their platform only to institutional brokers, but later expanded their platform to individuals. While Trade Station is an excellent choice for advanced traders, it extremely lacks any features that would draw in a beginning trader. Robinhood took the investing industry by storm by introducing the cheapest platform on the planet, totally free trading. This is drawn in a vast number of traders, especially beginning traders, to the stripped-down trading platform. At first, Robinhood might seem like the way to go.

But what you start peeling back the layers, free trading can cost you more than you could possibly believe. Mixing options together and how smart traders trade, but Robinhood platform can lock traders out due to its inability to calculate risk appropriately. If you want to make trades with high probabilities of success, it is recommended to have an experienced trading coach with substantial experience with options.

Having a professional options trader in your corner will allow you to see exactly how a seasoned veteran trades, what they look for, and the factors that really matter.

11 Best Options Trading Brokers and Platforms of April - NerdWallet

Make confident and decisive decisions that will allow you to take your trading game to the next level. Here investors are able to achieve trades that have a huge probability of success, while at the same time, defining an acceptable level of risk. Click here to apply expert research to your own portfolio. Skip to content. Table of Contents. Just click the link below to see our full presentation on exactly how we do it. All types of forex options trading should be considered high-risk investments. OTC and exchange-traded options - Visit Site For traders that can afford the USD 10, minimum deposit GBP for the UK , Saxo Bank offers competitive pricing, excellent trading platforms, brilliant research, reliable customer service, and over 40, instruments to trade.

Read full review. OTC and MTF-listed options Regulated and trusted across the globe, IG offers traders the ultimate package of excellent trading and research tools, industry-leading education, competitive pricing, and an extensive list of tradeable products. This fantastic all-round experience makes IG the best overall broker in OTC forwards and countdowns - Visit Site CMC Markets is a globally trusted broker that delivers a terrific offering for traders thanks to excellent pricing, nearly 10, tradeable instruments, and the Next Generation trading platform, which comes packed with quality research, innovative trading tools, and powerful charting.

US forex options - Visit Site Professional forex and CFD traders seeking a global multi-asset broker will find Interactive Brokers offers a sophisticated, institutional grade trading platform, and competitive fees. US forex options, US residents only With over 70 currency pairs to trade alongside a plethora of tools, research, and education, TD Ameritrade's thinkorswim platform provides US-based forex traders the ultimate trading technology experience.

Best Forex Options Brokers in 2021

OTC options only, great options app - Visit Site AvaTrade is a trusted global brand best known for offering traders an extensive selection of trading platform options. Our testing found AvaTrade to be great for copy trading, competitive for mobile, mostly in line with the industry average for pricing and research, and a winner for investor education. All forex options are either puts or calls, similar to regular options. Holding a put option conveys the right to sell while holding a call option conveys the right to buy.

Like regular options, forex options are a riskier investment. Below are seven terms every trader should know before trading forex options: Strike Price - The price level the contract can be exercised at i.

Here is a basic course on options. Below are examples of varying forex option types:. While not suitable for all investors, options can be attractive to forex traders due to their inherent properties not found in other forex instruments.

Main Takeaways: Puts vs. Calls in Options Trading

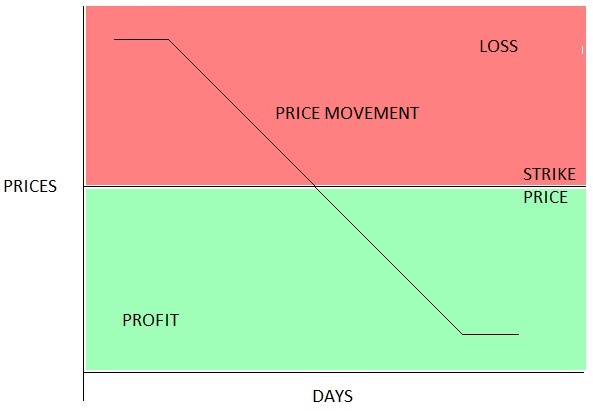

Below is a list of some of the perceived advantages of why investors trade forex options trading:. A put option is a bearish short position that profits when the price of the underlying decreases. A call option is a bullish long position that profits when the price of the underlying increases. The option should have enough remaining time-value to cover the trader's forecasted time-horizon for that trade. Depending on what you are expecting in the market for a given forex pair and time-frame, there are over a dozen popular strategies used to establish an options position with predefined risk in anticipation of specific market behavior related to price direction and volatility, some of which are listed below: A combination position includes more than one option in the same contract at the same time.

A straddle or strangle combines writing or purchasing both a put and call at the same strike price or different strike prices and the same expiration date. A spread position is one where you are both the buyer and the writer seller of the same type of option, although strike price and expiry dates can be different.

How do forex options differ across brokers? Forex options are financial assets that may vary in terms of the numerous rules and structures they follow, which can result in various levels of complexity. Below are some of the most common ways forex options differ across brokers: Broker or exchange execution policies Default contract sizes and specifications Type of option styles and products available Trading symbols for the same underlying currency What are exotic forex options?

Some forex options lose value if the underlying spot price touches a barrier level, such as a turbo warrant known as turbos, or touch brackets.