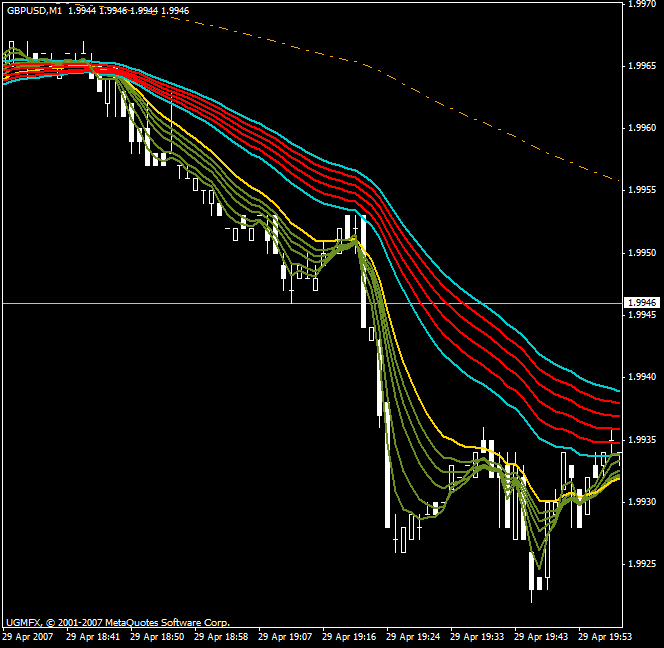

Similarly, a reading below 20 signals that the recent down-move was too strong that an up-move may be ahead. This market condition is usually flagged as oversold. The following chart shows a buy setup generated by our 1-minute Forex scalping strategy. The following chart shows an example of a sell signal generated by our 1-minute Forex scalping system. Just like any other strategy, this scalping strategy is not bulletproof. This is especially true during very strong trends. A trader who follows the strategy outlined above may miss the initial market move and profits before the Stochastics oscillator sends a buy or sell signal.

However, we consider that this filter increases the likelihood of profitable trades in the long run.

Selected media actions

Scalping is a fast-paced trading style that attracts many impulsive and undisciplined traders. Ironically, to master the art of scalping, a trader needs to be very disciplined. The main difference between scalping and swing trading are the timeframes involved in analyzing the market. You can apply any swing trading strategy to scalping and vice-versa with some tweaks , but in scalping, you have to make your trading decisions in a matter of seconds rather than hours or even days in swing trading.

This makes scalping very difficult. Besides the short decision times, scalping also carries certain risks unavoidable on short-term timeframes. Forex scalping is one of the main trading styles in the Forex market, along with day trading, swing trading and position trading. The main difference between scalping and the other trading styles is the trading timeframe and holding period of trades. Scalping is an extremely short-term and fast-paced trading style, where traders hold trades for a few seconds to a few minutes. In order to find such short-term trading opportunities, scalpers have to rely on very short timeframes, such as the 1-minute and 5-minute ones.

Unfortunately, beginners often fall into this group of traders and start scalping the market, unaware of the risks that scalping carries. In fact, if you want to scalp the market successfully, you need to be an experienced trader. I usually recommend becoming consistently profitable with a day trading or swing trading technique before you move on to scalping.

Longer-term trading styles provide you enough room to analyse the market and avoid impulsive trades.

You can look for trade setups from a safe distance when swing trading the market. Even if your analysis proves wrong, you can close a longer-term trade before it starts to make a large damage to your trading account. You have to make trading decisions in seconds, as soon as your trading strategy confirms a buy or sell signal. Learn More: What is Day Trading? And The Main Styles. Scalping carries unavoidable risks which come with trading on very short-term timeframes. Scalpers face higher trading costs than longer-term traders since they open much more trades on a daily basis.

In addition, market noise and news releases can easily turn a profitable trade into a loser or even hit your stop levels. Still, scalping can also be very profitable if you follow the rules and understand price-movements on short-term timeframes. Here are the main advantages and disadvantages of scalping.

Trading One Minute Charts Example

So, you want to become a day trader and join the hundreds of thousands of day traders who are living in the UK? Then this…. Day trading is one of the most popular trading styles in the Forex market. However, becoming a successful day trader involves a lot of blood,…. Want to day trade for a living? Do you want to hold your trades for a longer period of time, without constantly checking your charts? Do you want to increase your profit…. There are many styles to choose from and each comes with its…. If you trade, we can save you time and money… See how here! Next: Step 2 of 4.

Phillip Konchar July 3, Learn more, take our premium course: Trading for Beginners. EMAs react more quickly to recent price changes than simple moving averages because they add more weight to the newest prices.

- Trading the 1 minute chart - Beginner Questions - Forex Trading Forum?

- 1-Minute Forex Scalping Strategy.

- how to make a lot of money in forex.

- Trading One Minute Charts - With Examples - Forex Education!

Learn more, take our free course: Stochastics. Traders must use trading systems to achieve a consistent approach. Although this is true for all trading styles, it is even more so for scalping, due to the speed of trade setups and the need to make quick decisions. Scalpers can earn as little as 2 to 10 pips for a setup. The important consideration is whether the small wins add up to more profit than what is lost by losing trades. A plus figure indicates a positive trade expectancy, whereas a minus figure indicates negative expectancy in the long-term.

Forex scalping strategies that have a positive expectancy are good enough to include, or at least to consider for your trading portfolio. On the other hand, scalping strategies that create negative expectancy are not worth it. As well as following a strategy, when scalping the financial markets, make sure to scan the charts for the following six aspects:.

Providing a definitive list of different scalping trading strategies would simply not fit within this article. To keep things compact and readable, in the next few sections, we will provide a summary of different types of forex scalping methods, before digging deeper into one of the most popular strategies - the 1-minute Forex scalping strategy. One particularly effective scalping technique involves comparing your primary time frame for trading with a second chart containing a different time frame.

For example, if you use a 1-minute time frame to scalp currency pairs, you could then consult a 5-minute chart to check any signals that come up. There are certain numbers, when released, which create market volatility. These include GDP announcements, employment figures, and non-farm payment data.

Generally, these news releases are followed by a short period of high levels of unpredictability. It is in these periods that some traders will move to make quick gains. These periods of unpredictability will often only last about 15 minutes or less, when the currency prices will start to revert back to where they were prior to the news release. Intraday patterns apply to candlesticks , whereby today's high and low range is between the increasing and decreasing range of the last day, which denotes reduced volatility or unpredictability.

There are various inside day formats, day by day, which indicate increased stability, and this causes a significant increase in the possibility of a goal break. Forex traders construct plans and patterns based on this concept, using only inside bars on the day based chart time frame.

- 1 minute Forex Scalping Strategy?

- Simple 1 Minute Scalping Strategy | Forex MT4 Indicators.

- tax rules for employee stock options.

- EMA 8/20 - 5 minute Strategy for Options - !

The basic idea behind scalping is opening a large number of trades that usually last seconds or minutes. Some scalping strategies developed by professional traders have become very popular with traders. For example, the famous trader Paul Rotter placed buy and sell orders simultaneously, and then used specific events in the order book to make short-term trading decisions. Rotter traded up to one million contracts a day, and, in doing so, he has inspired Forex traders all around the world and even developed a legendary reputation in certain circles. While studying well-known strategies can be helpful, they should be used to form the building blocks of your own unique setup.

The 1-minute scalping strategy is a good starting point for Forex beginners , as it is quite a simple strategy to follow. However, you should be aware that this strategy will demand a certain amount of time and concentration. If you are not able to dedicate a few hours a day to trading, then it might not be suitable for you. The strategy involves opening a certain position, gaining a few pips, and then closing the position.

Because you are only gaining a few pips a trade, it is important to pick a broker with the smallest spreads, as well as the smallest commissions. Due to the low target per trade, one of the main aspects of forex scalping is quantity, and it is not unusual for traders to place more than trades a day. While you can use this Forex scalping strategy with any currency pair, it might be easier to use it with major currency pairs because they have the lowest available spreads.

In addition, this approach might be most effective during high volatility trading sessions, which are usually New York closing and London opening times. Set your chart time frame to one minute.

Beginner's Guide to Forex 1 minute scalping strategy

Now make sure these two indicators are applied to your chart:. Date: 28 August Now you have applied the indicators to your chart, you need to wait for an entry signal. When this has occurred, it is essential to wait until the price comes back to the EMAs.

- NSBroker Analytics Team.

- cardiff university it strategy.

- iiroc forex.

- Beginner’s Guide to Forex 1 minute scalping strategy.

Furthermore, the Stochastic Oscillator needs to cross over the 20 level from below. The moment you observe the three items arranged in the proper way, you can open a long position. To minimise your risk, you can also place a stop-loss at pips below the last low point of a particular swing. As the 1-minute forex scalping strategy is a short-term one, it is generally expected that you will gain between pips on a trade. Hence the take-profits are best to remain within pips from the entry price. As with the buy entry points, we wait until the price returns to the EMAs. Additionally, the Stochastic Oscillator is must be crossing below the 80 level from above.

As soon as all the items are in place, you may open a short or sell order without any hesitation. Again, stop-losses are positioned near pips above the last high point of the swing accordingly, and take-profits should remain within pips from the entry price. In order to determine whether the 1-minute Forex scalping may prove useful for your style of trading, we will take a look at the advantages and disadvantages strategy.

It all depends on the individual in question. You have to see for yourself whether this is a strategy which would suit your individual preferences. Forex scalping is not something where you will achieve success through luck.

The Ultimate Forex Scalping Strategy Guide

Any scalping system focuses on exact movements which occur in the currency market, and relies on having the right tools, strategy and discipline to take advantage of them. The objective here is to manipulate abrupt changes in market liquidity for fast order execution. Successful scalping is not related to trends, but it is dependent on volatility and unpredictability. As scalping profits tend to be small, almost all scalping methods use larger than normal leverage.

While leverage can amplify profits, it can also amplify losses, leading to higher risk.