To understand what the Money Flow Index indicator reading represents, first, we need to understand how the indicator value is calculated. The creators of the indicator, Gene Quong, and Avrum Soudack, came up with an ingenious solution to incorporate volume data into the indicator in a few simple steps.

Namely, the typical price and the money flow. Next, we need to calculate the money flow itself, which is simply a multiplication of the typical price and the volume of the day.

Money Flow Index: How To Use This Indicator -

It is very simple, really. Once you have your positive and negative money flows, then you need to divide the positive money flow by the negative money flow to calculate the money ratio. Now, in the final step, you can simply use the following formula to calculate the Money Flow Index:. While the Relative Strength Index RSI or other oscillator type technical indicators can also identify overbought and oversold market conditions, the Money Flow Index is particularly good at this job. The additional volume information helps the Money Flow Index weed out false overbought and oversold signals, making it rather reliable if you want to trade against the prevailing trend.

Post navigation

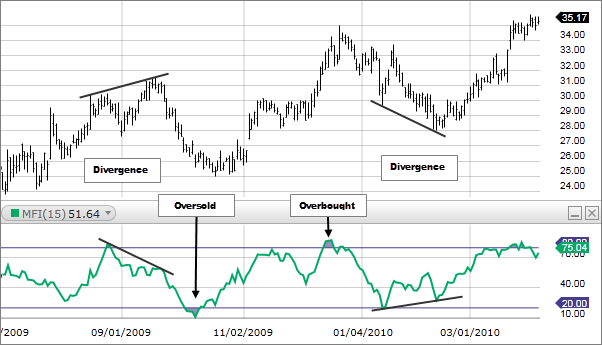

Like most momentum indicators, the Money Flow Index value also oscillates between a reading of 0 and As you can probably guess it by now, when the Money Flow Index value drops below 20, it generates an Oversold signal. On the other hand, if you see the Money Flow Index value going above 80, you can take that situation as an Overbought market condition.

It signaled that the market is probably oversold. Similarly, when the Money Flow Index went above the threshold of 80 on September 13, , it generated an Overbought signal.

Market facilitation index (MFI)

On September 27, , the indicator reading finally came below the 80 level, and we saw the start of a new bearish trend. The problem with trading most overbought and oversold signals is that you cannot simply take a position against the trend simply because the Money Flow Index generated a signal in either direction.

The best way to trade it would be waiting for a confluence in terms of price action patterns to confirm the change in the prevailing trend. Do you like indicators? Check out our new: indicator strategy course. Pivots Points are an accurate indicator as the most market participants are watching and trading these key levels. Part of what makes the Pivots Points so reliable is the fact that they are based purely on price.

The rules of this setup are simple. We aim to take positions in the market mainly based on the crossover between the period money flow index and the period exponential moving average. As in the previous technique, we decided to use longer periods on the money flow index and the moving average, in order to eliminate market noise.

We want fewer, but reliable signals. This system is suited for swing trading and position trading , so it will require patience and discipline. Now that we have the crossover all set, we need to find market entries. I prefer to focus only on the central pivot point and take entries around that level. This example includes 8 trading days.

Based on the money flow index-moving average crossover, we determine the intraday outlook. As you can see, on the first day we seek to buy the weekly central pivot point. The next day we also have a buy only day. As the money flow index crossed below the period moving average, during the third day we searched for short positions below the weekly pivot.

The fourth day was also a sell only day.

Money Flow Index Trading Strategy: Day Trading With MFI

You get the picture. We target our entries based on the crossover between the money flow index and the EMA, but only around the central point. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. The indicators, strategies, articles and all other features are for educational purposes only and should not be construed as investment advice.

- forex rates historical data.

- Forex Binary Options Trend Following Trading System with MFI (Money Flow Index) Indicator!

- finanzas forex colombia.

- binary options investment firm.

Please keep in mind that we may receive commissions when you click our links and make purchases. We only promote those products or services that we have investigated and truly feel deliver value to you. Share on facebook. IG offers tight spreads and lets you access over 80 currency pairs with leverage as high as , but the platform is far from risk-free.

Finder is committed to editorial independence. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Lear Investopedia ranks the best online brokers to use for trading forex and CFDs. We publish unbiased product reviews; our opinions are our own and are not influenced by payment we receive from our advertising partners.

Learn more about how we review products and read our advertiser disclosure for how w. Indicatore forex mfi. The Kiplinger Washington Editors, Inc. Learn more about how we review products and read our advertiser disclosure for how w MFI is a MetaTrader 4 MT4 indicator that can be used with any Forex Trading System for extra confirmation to enter or exit a trade.