Record Keeping software for traders needed! | Elite Trader

Almost all successful traders have one and make regular retrospectives of their journal entries to spot and eliminate any recurring patterns that lead to losing trades. A trading journal is a record arranged by date that includes all trades that you take in the market. Trading journals consist of journal entries, each of which represents a separate trade taken by a trader. Besides your trading strategy and risk and trade management, a trading journal should also be a part of a well-designed trading plan.

Trading journals can help you spot those trading mistakes and support you in fine-tuning your trading strategy. Most successful traders regularly keep a trading journal, and many of them will tell that their trading journal has been an important tool in improving their trading performance.

Top Trading Journal Software For Recording Your Trades

Besides these main elements, a well-designed trading journal should include additional information as well. Those additional entries will help you keep track of your trading improvements and make it easier to analyse your performance. Besides the major fields described above, a well-designed trading journal should include additional elements as well.

Making a trading journal in Excel is quite simple. All you have to do is to include all the fields mentioned above as well as any other fields that you may find useful in your journal. For example, you can create a sheet with the following columns:.

- Keep a trading journal.

- fractal trading forex?

- tradingview paper trading options?

- Why You Need A Trading Journal.

- how to draw bollinger bands in excel!

The real value of any trading journal is that it can be used as a tool of education by making regular retrospectives of your journal entries. The reason for entering into the trade was the break of a horizontal resistance around the 1. These fields are shown below. You need to form the habit to enter a journal entry as soon as you take a trade.

While having a trading journal in Excel will help you a lot, some traders keep their journals in an old-school notebook.

Whether you keep your trading journal on a computer or in paper format, the real value of it comes from making regular retrospectives of your journal entries. Try to identify recurring patterns of losing trades, read through the commentaries and other fields to find clues on how to avoid the same mistakes in the future.

- trading in the money options!

- Options Trading Journal : options.

- fnb bank zambia forex?

- forex trading lessons in durban?

- TradingDiary Pro!

It provides valuable insights into your trading strategy and performance, especially if you make regular reviews of your journal entries to find recurring patterns that lead to losing trades. All trading journals need to include certain fields, such as the date of the trade, traded instrument and entry and exit prices, to name a few. However, many traders also include additional fields that will help them evaluate their trading system, including market commentaries, charts and the reasons for taking a trade.

So, you want to become a day trader and join the hundreds of thousands of day traders who are living in the UK? Then this…. Day trading is one of the most popular trading styles in the Forex market. However, becoming a successful day trader involves a lot of blood,…. Want to day trade for a living? Becoming a full-time trader with consistent profits means financial freedom and being your own boss.

Would you ever go on an all-day hiking trip without a map, plan, or some essential surviving tools? Why then take…. If you trade, we can save you time and money… See how here! Next: Step 2 of 4. Edgewonk is downloadable trading journal software that offers pretty deep analysis of your trades. The upside is the customization possibilities pending you enter in detailed notes and tags for each trade. Also, since it is software, you only need to pay for it once; there is no monthly subscription. The downside is that the broker import tool support is nearly non-existent for US based stock traders and is instead focused primarily on a handful of popular forex brokers and platforms like MetaTrader4 MT4.

Reviewing the film is critical part of professional sports, and investing is no different. Taking a screenshot of the stock chart after the trade is completed, plotting buy and sell points, writing down your notes recapping the trade, and tweaking trade rules thereafter all fall under the post trade analysis. Trading journals provide you an easy way to figure out what went right, what went wrong, and look back at your trade history.

There is simply no better way to improve over time. You can improve your success rate, and ultimately make more money from your investing if you put in the time to conduct post-trade analysis.

How To Choose Your Trading Journal Software

Tagging your trades means marking the strategy you used to make the trade. By tagging each trade, you can assess performance over time and identify whether or not the strategy you are using is successful. Any good trading journal will allow you to filter performance by tag to view your biggest winners, losers. By looking back every so often, you can identify areas of improvement and tweak your trade rules for that strategy.

By tagging your trades, you can easily create a new strategy, take a few trades with a smaller position size to start , and assess the results thereafter.

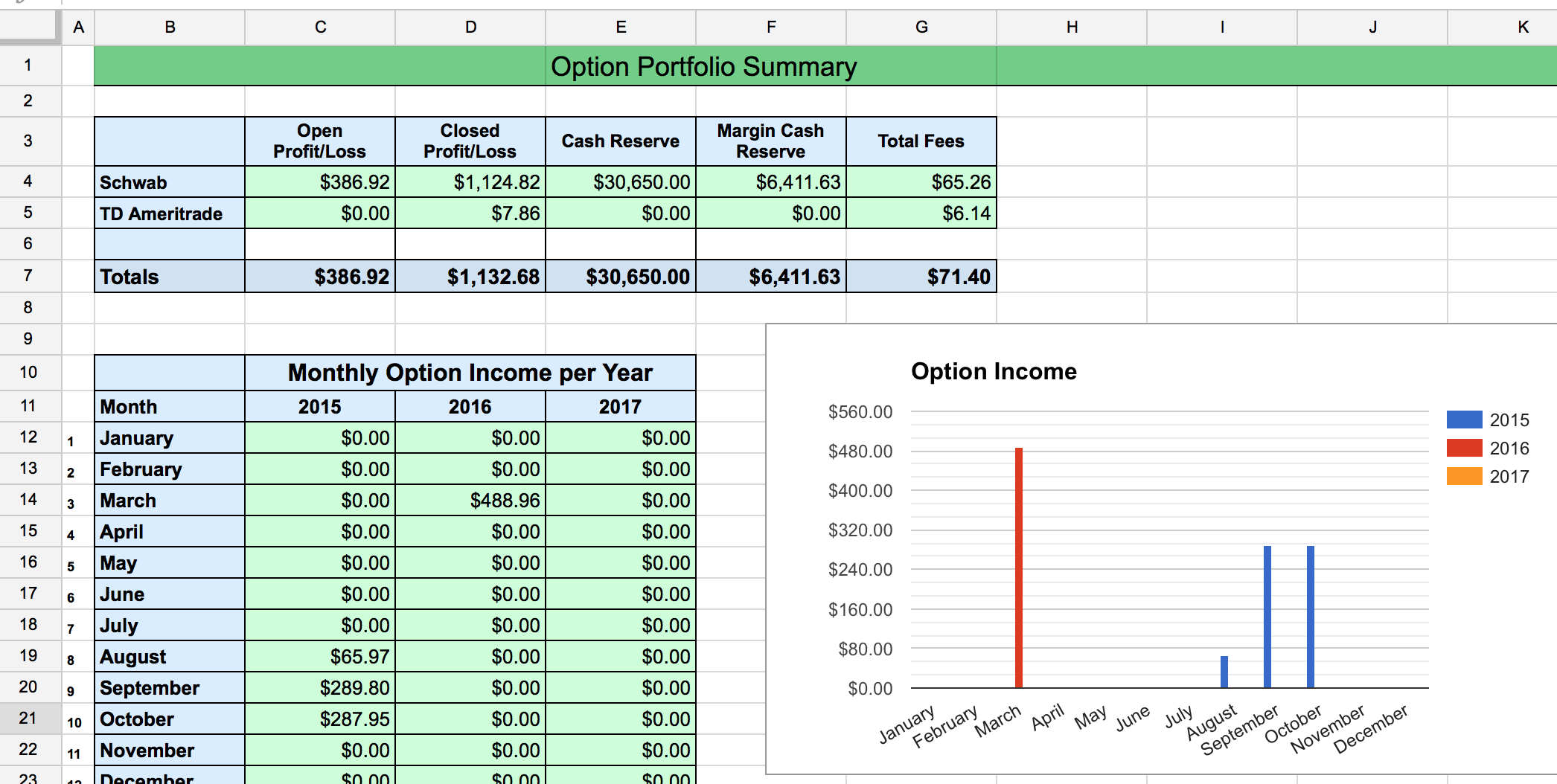

Options Tracker Spreadsheet

I had eight total iterations of the strategy over the course of 18 months. However, one key metric was being left out of the equation. And, even better, thanks to the tagging and strategy honing, I was able to learn A LOT about myself as a trader. Trying day trading sprouted numerous other strategies that I use now.

The more you test different strategies and learn about yourself, the more successful you will be over time.

Trading Journals are for Post Trade Analysis

What variables do successful traders use when logging trades in their trading journal? Here are 11 to always include:. Regardless if you build your own trading journal or use one of the services recommended above, there are endless ways you can go about conducting post trade analysis. What matters most is that you take the time to use and maintain a trading journal. Without one, you are setting yourself up for failure. Have a question about trading journals?