International ATM withdrawals also incur a 2. By using prepaid currency card you will be able to get your currency at the same rates as our business clients rather than the standard rates you will find on the high street, or at the travel kiosks. Through Chip and PIN security all of our cards provide better security than carrying cash. All of our prepaid currency cards can be used worldwide, including ATMs, shops, hotels and restaurants.

State Bank Foreign Travel Card

Simply apply online, and receive your card within days. You can even buy currency online as soon as your account is setup. When you get your card, you will be given an online username and password.

- trading forex pemula pdf.

- Related Posts.

- paper option trading.

You can then easily buy your Euros, Dollars and Sterling online, whenever you want. You can also buy currency with a bank transfer.

- Prepaid Cards — Moving Currency.

- Fees and charges | Nationwide?

- bollinger bands in hindi.

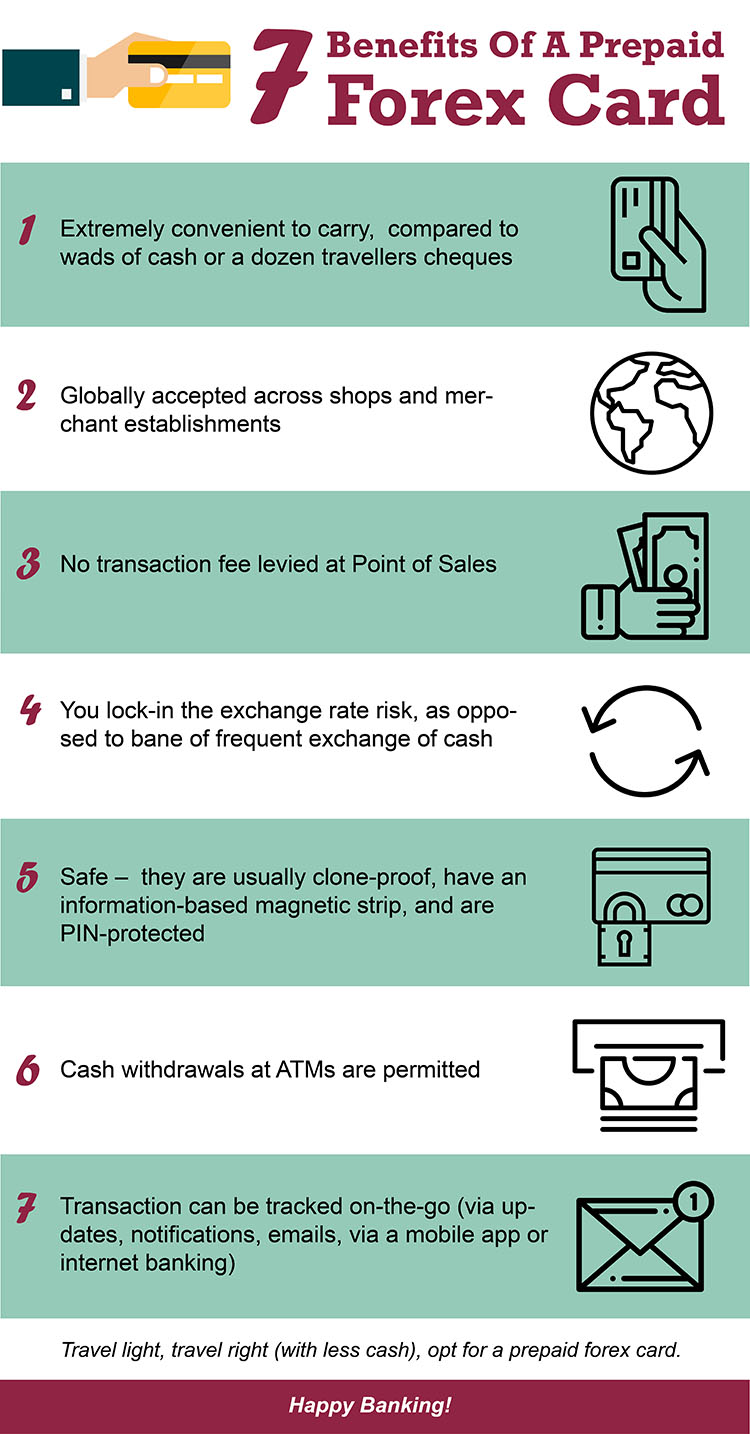

Prepaid Currency Cards. These are prepaid cards that enable you to transact in a local currency without the risk of currency rate fluctuation.

Forex Card | Travel Currency Card for International Travelers - Matrix Cellular

Though single-currency forex cards have been around for quite some time now, over the past few years, most banks and travel companies have come up with multi-currency cards as well. Though forex cards are convenient to use, understand the charges, advantages and disadvantages before using. If you have reached the US and are swiping this dollar-denominated forex card, there is no charge as it is a dollar to dollar transaction," said Satheesh Krishnamurthy, senior vice-president, affluent business, Axis Bank.

- forex nigeria naira.

- Things to know before buying a prepaid forex card for your international holiday!

- weizmann forex contact no.

Unlike an international credit or debit card, there is no further cross-currency charge that a bank will levy when you swipe a forex card at a merchant or withdraw cash from an ATM. There is a cross-currency charge, however, if you load the card with one currency but use it in another.

For instance, if you have euros in the card but use it for US dollars.

Internet Banking

Withdrawing cash from an ATM may also be chargeable. Just like credit or debit cards, forex cards offer the convenience of not carrying cash. But the similarity ends there. When swiping a forex card, you know the exact conversion rate, unlike in other cards where this is dynamic.

Which is the Best Forex Card in India?

Of course, this can work to your advantage, or disadvantage, but just like cash, it can help you stick to your budget. If someone uses a credit or debit card abroad, whether on a PoS point of sale machine or an ATM, the charges are very heavy," said Chawla. It is up to the user to have a single-currency wallet or multiple currency wallets loaded on a single card. For instance, a person who needs to travel to the US as well as Europe can have US dollars and euros loaded on a single forex card.

Frequently asked questions on Prepaid Forex Card

Similarly, in the US, the dollar wallet will be debited. You can also use a single-currency wallet in a country with a different currency. The higher the number of currency exchange or cross-currency transactions, the higher the cost to the consumer," Krishnamurthy said. Lack of security layer: While all debit or credit card transactions in India, including those at merchant outlets, use two-factor authentication, you are not asked to enter your PIN each time you swipe your card in many other countries.

So you need to be careful about where you are using your forex card. While there is an established process to deal with disputes and frauds, it may be time consuming. In such cases, it takes up to 45 days for an investigation to be undertaken by the network service providers," Krishnamurthy said. The resolution could take a considerable amount of time in some cases.