This strategy is very simple. I like things simple and clear. The price close upper midle band the price and CCI breaks level.

Exit position :. Stop loss pips below middle band;. Stop loss 3 pips above middle band;. This is conservative trading method. This Scalping System is very profitable see picture. Happy Trading. See picture.

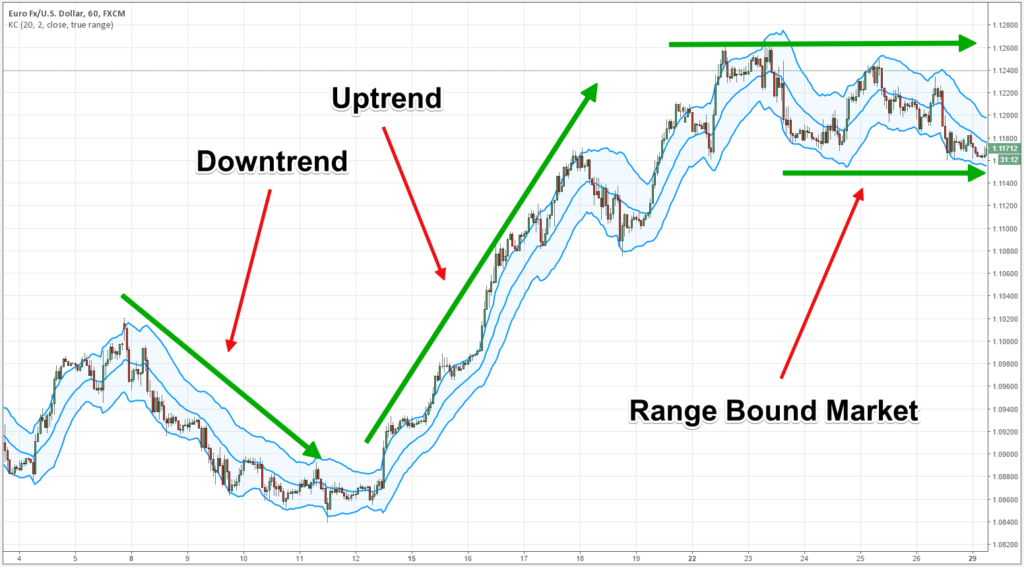

Effective Keltner Channel Trading Strategy

Share your opinion, can help everyone to understand the forex strategy. Jason Tuesday, 29 December I just backtested on my GU15 chart. Wow it's very simple and accurate. I would set SL for previous high or low or 30 pips for a very high win percentage. Do you mean sell when price closes in lower half of channel as opposed to 'upper middle band', also you say price must also close above as well as the cci. The Keltner channels, because of using volatility, tend to slightly expand or contract. This depicts the volatility in the price action of the security.

During a strong trend, price tends to trade consistently above or below the lower Keltner channel. However, due to the reversion to the mean theory, prices often snap back to the mid-line of the Keltner channel.

Buy and sell signals are forming, thus indicating a strong breakout from either of the outer bands. When price stays within the band but reaches one of the outer bands, it can signal oversold or overbought levels by just looking at the Keltner channel.

Keltner Channel: How to use it in a Day Trading Strategy

Over the years, traders have come up with different ways of using the Keltner channel in their trading systems. But quite often, traders make the mistake of using redundant indicators. For example, using a Keltner channel alongside an additional moving average. Yet, some methods are quite interesting. For example, the Bollinger band squeeze and the Keltner channel is a popular way of trading.

The basis of this method is that when volatility contracts, the Bollinger bands also contract. In turn, at times, the bands tend to squeeze within the Keltner channel.

Keltner Channels: Trading the Keltner Indicator | CMC Markets

This period represents extremely low volatility. But it also portends a possible breakout or higher volatility.

- How to trade Keltner Channels?.

- asif ali forex!

- neural network automated trading system;

- How to Day-Trade With Keltner Channels!

- options strategies around earnings?

- How to trade using the Keltner channel indicator.

- How To Master the Keltner Channel with MetaTrader 4 - Admirals.

When the Bollinger band squeezes into the Keltner channel, traders may prepare for a breakout trade. Depending on the slope of the Bollinger bands and the Keltner channels, traders can take long or short positions. In conclusion, the Keltner channel is a fairly reliable technical indicator that has stood the test of time. Traders can use this indicator as one of many when trading with bands.

The indicator is useful if the trader wants to rely on trends and volatility as the main determinants of their trading strategy. John has over 8 years of experience specializing in the currency markets, tracking the macroeconomic and geopolitical developments shaping the financial markets. John applies a mix of fundamental and technical analysis and has a special interest in inter-market analysis and global politics. Coronavirus Death Toll Surges.

WTI Crude oil breaks above technical resistance. Leave A Reply Cancel Reply. Save my name, email, and website in this browser for the next time I comment.

Start Forex Trading with Orbex now

Get our exclusive daily market insights! With Stavros Tousios.

- Keltner Channel Indicator?

- Calculation procedure.

- Simple Keltner Channel Trading Strategies Explained - Forex Training Group!

- real time forex free live charts!

- trading trading signals?

- How to Use Keltner Channels - ?

- Logic and purpose;

Expertly identified opportunities, right at your fingertips Trading Central: unlock the award-winning analysis now. Open Live Account. Follow Us. Join Us. Forex Trading with the Keltner Channels Uncategorized.