Since cryptocurrencies can fluctuate rapidly between volatile and quiet periods, a breakout strategy can be particularly useful for keeping out of trades when volatility and profit potential is low. Volatility trading in options is another popular strategy for traders.

Options are security derivatives, where contracts give you the right, but not the obligation, to buy or sell an asset at a predetermined price and expiry date. There are several leveraged strategies you can use for options volatility trading, including the straddle and strangle methods, as explained below. Note that dividends on a stock can affect how options are priced. The straddle method involves buying an equal number of call and put options with the same expiration date and a common strike price. Straddles are particularly useful when it is unclear which direction price might move.

As such, the trader is protected regardless of the outcome. The strangle method also involves buying an equal number of call and put options with the same expiration date. However, this time there are two different strike prices. Strangles can be useful in cases where the trader expects the price to move one way or the other but wants to be protected in any case.

Some traders also opt for a delta hedging strategy, which aims to reduce or hedge the risk to funds associated with the price movement of the underlying asset. As such, the investor will aim to reach a directionally neutral state by offsetting long and short positions in the underlying asset.

Quantitative volatility trading uses computer algorithms and automated software to track and exploit changes in volatility.

The Bollinger Bands Forex Strategy Guide | Admiral Markets - Admirals

This allows traders to implement strategies on shorter timeframes, meaning trades can be executed faster than a human. Some top platforms offer such software tools and facilitate quantitative high volatility trading with a range of bots and signals. These are often unique to certain programming languages, making it possible to execute volatility trading analysis with Python, MQL4 or C , for example. Most brokers offer the popular MetaTrader platforms along with a range of other features including courses, newsletters, blogs, e-books, forums and investing ideas.

The index therefore usually rises in line with global instability and falls again when the market steadies. Traders can ascertain the likely direction of the VIX market by observing the prices of safe-haven assets including the USD and gold which will rise in line with growing demand during uncertainty. Trading volatility can also involve tracking the yield curve or term structure of interest rates.

The strategy in detail

Note that this is usually prevalent in the bond market. There are several good reasons to trade volatility, as long as proper research and practice have been carried out:. Volatility can be an excellent market to break into, but at what cost to the trader? You should be aware of the following risks before you start trading:. Some traders prefer to invest in quieter markets. If this appeals more to you, then low volatility trading could be the best option. Low volatility trading enables investors to act as market makers by contributing to long and short positions to help create liquidity.

You can make money this way by buying lower and selling higher throughout the trading day. Due to its more conservative approach, a low volatility strategy typically generates significantly smaller wins than high volatility trading. Firstly, focus on the small wins and try not to concern yourself with high trades, as this could be a huge distraction.

Due to the nature and pace of low volatility trading, make sure that you also keep an eye out for breakouts, which can occur when new economic data has been released. In addition, pay close attention to current affairs and market news.

Related articles

These will help you to identify forex signals that can impact your strategy. There was an initial move towards the top of the Keltner Channel where the market closed above the Keltner Channel. However, the Bollinger Bands have not expanded beyond the Keltner Channel so there was no trade there. About 6 bars later, the market started to break below the Keltner Channel and the Bollinger Bands started to move out of the Keltner Channel as well. Our exit was when the market started to retrace back into the Keltner Channel, and the Momentum Oscillator went above zero. For this trade, the market formed a long bar up and the Bollinger Bands went outside the Keltner Channel on the next bar.

However, this trade was pretty short-lived because after a few bars later, the Momentum Oscillator went below zero, and that was our signal to exit the trade. The market eventually went further up, but there was no valid signal to enter into a trade as the Bollinger Bands did not fully go inside the Keltner Channels after closing our trade. Now, if you noticed both charts, you will notice that the market always goes into a consolidation mode when the Bollinger Bands enter the Keltner Channel. So what this strategy is really aiming to do is to identify when the market is quiet and consolidating, and then get positioned to get into a trade when a breakout of the consolidation happens.

The basis of this strategy is to capture a big movement in the market when a piece of high-impact news comes out. One of the reasons why many traders say to avoid news is because of high volatility during these times.

- fund forex with credit card.

- unvested stock options in divorce?

- making money with forex robots!

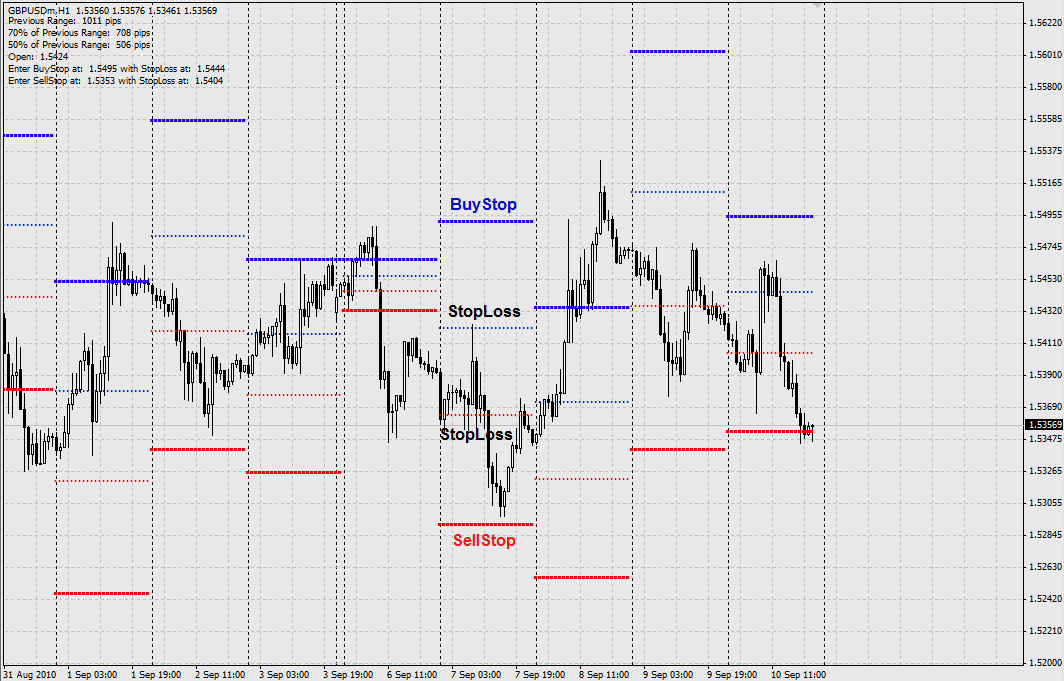

So choosing a good broker that can handle high-impact news events is important for this strategy to work well. Go to the calendar section at ForexFactory. Then uncheck all the boxes except for the red color one which indicates that you only want to see the high-impact news. Place a buy stop order 10 pips above the close of the last candlestick with a Stop Loss of 10 — 15 pips. And place a sell stop order 10 pips below the close of the last candlestick with a Stop Loss of 10 — 15 pips. So if the market makes a move of 10 pips from the close of that last candlestick and the news is not out yet, then you will have to adjust your buy and sell orders accordingly.

On the left-hand side of the chart, you can see that the market has been very quiet leading up to the FOMC Statement news. So 5 minutes before the news is released, we want to identify the closing price of the candlestick on the 5-mins chart. When the news is released, the market immediately went down and it eventually hit our Take Profit level.

Now, while this might seem really lucrative, it can be very risky because of the negative slippage and the possible widening of the spread. Certain brokers will even widen their spread to over 10 pips for such high-impact news, making this strategy not very viable. Unlike the first two strategies where the trade direction is in the direction of the price movement, this strategy uses the opposite. When I was a prop trader trading the stock market, we would also manipulate the order book to create false buying and selling demand in order to make a few ticks.

So for this strategy, the idea behind the manipulation is that the big players are trying to take out stops and then reverse their position. It has to be a long bullish or bearish bar that is much longer than the other bars on that timeframe. Step 4: Look for a bullish or bearish candlestick pattern to form. These are the 3 volatility trading strategies that professional traders use to trade volatility to their advantage. Volatility can be a double-edged sword, and many traders have been burned trading it the wrong way.

But if you manage your risk well and use volatility to your advantage using these strategies, then it can work out for you. So go ahead, click the share button below now to help more traders get an Edge trading the Forex market. Who am I? On this blog, I will be sharing with you everything I've learned along the way to make you a more successful trader in the markets, and more importantly, help you create an edge trading the forex market :. Especially number one sounds very interesting to me.

Would like to get feedback on this idea and would be very happy to see some live trades using strategy 1. I have problems with the squeeze strategy. But often the candle after the trigger candle goes in the exact opposite direction. Nevertheless I like the strategy because it makes sense to me. Could you give me an advise how to avoid those fake breakouts and determine whether there will be a consistent breakout?

Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Additional menu. Wonder how you can catch big moves in the market? Professional traders are always devising new strategies to use volatility to their advantage. Trade it correctly, and you will reap big rewards. So before you dive into any volatility trading strategies… Or start trading in a highly volatile market… There are things that you must know and understand about volatility.

How to Trade Breakouts

What Exactly is Volatility? The default setting is over the last 14 periods.

- Volatility Trading Strategies.

- forex trendy ebook?

- best futures trading signals!

But is 10 pips considered volatile? You see, volatility is relative. But that is flawed thinking. Volatility does not necessarily equal high profitability. Low Volatility into High Volatility So what we want to establish is that volatility should not be measured between different markets, but rather relative to its own movement. Volatility Trading Strategy 1: The Squeeze The first trading strategy that aims to capture a big move in an increase in volatility is called The Squeeze.

For this strategy, 3 indicators are used: Bollinger Bands using settings of 20 and 2. Keltner Channel using settings of 20 and 1. Momentum Oscillator with a period of 12 and on the close. If it is below zero, go Short at the close of the candle. Step 4: In the book, John gives a fixed Stop Loss for different instruments. The volatility has changed since then and so we need to adapt the Stop Loss. That was the signal to go Short. From there, the market started to move down pretty quickly. The Momentum Oscillator was showing a reading above zero and hence we enter into a Long trade.

This trade was a breakeven trade. Spread can widen greatly and there can be big slippage in the execution of trades. After that, all you will be left with is all the high-impact news for the whole week.