Option (finance) - Wikipedia

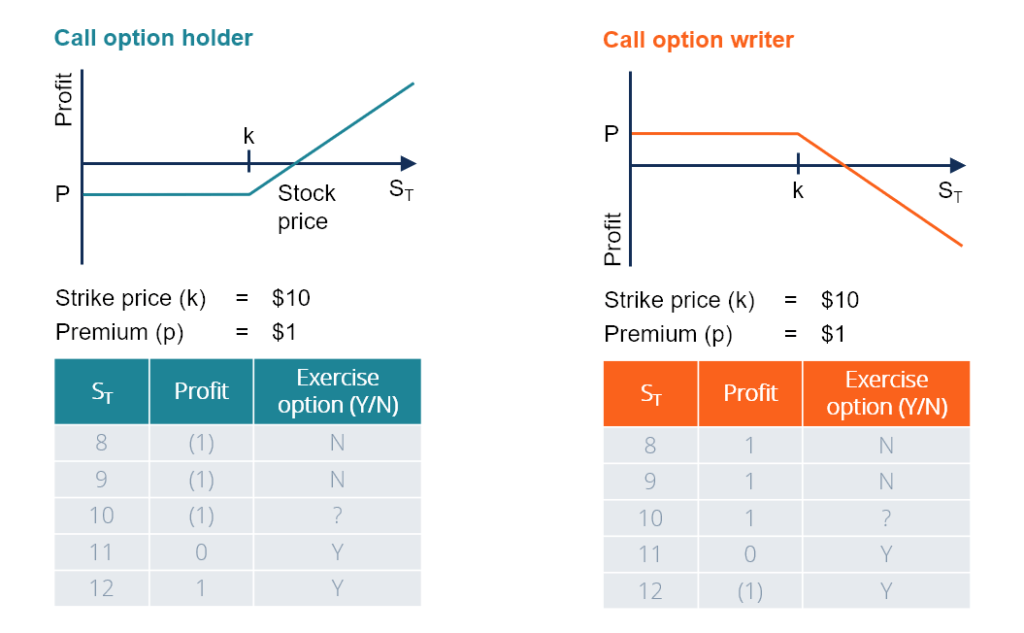

If you buy a call option, you get the right to buy the underlying stock from the option seller at the set price during a set amount of time. If you are the seller of the call option, you become obligated to sell your stock to the buyer at the set price if the buyer requests it within the set time. If you own a company, and you sell someone the right to buy your stock at a price higher than you think the stock is worth, then there is almost no risk at all.

If the stock price goes up to that unexpectedly high price, you would want to sell the stock anyway. You should always aim to sell into greed and to buy into fear. When greed is pushing the stock price up like a rocket, you want to be a seller of that stock.

You can increase your cash flow by selling call options, which give the buyer the right to buy your stock at a set higher price. If the stock price goes up beyond the set price, then you will sell the stock to the buyer. Either way, you win. There is virtually no risk, and we get more money for selling stock that we would have sold anyway. You look at the options quotes and select a call option for with a premium of 37 cents with an expiration date of next month. Whether the stock price goes up or down, you still come out ahead. Put Option Definition : In a put option contract, the buyer gets the right to sell the underlying stock to the option seller at the specified price within the specified time, usually in a month or so.

While you are waiting for the price to come down, you pick up a bit of income, and when the price does come down, you are happy to buy it from the option holder at the lower price. Selling naked puts is a very good strategy when you are totally solid on the value of the business. The problem with selling a naked put in the current market is that you might have to buy the stock at a price that is quite a bit higher than the price the stock is selling for — and that hurts.

Learn how to Master the Market from Your Home!

Best Options Brokers

Attend My 3-Day Virtual Workshop. I love to be in cash and watch a price crash on a business I want to buy. I LOVE it! Especially since we know that Mr. It is just horrible to have to pay more when Mr. Market is being so cooperative as to sell it to us at a massive discount below its true value. And there are more extreme examples that come up from time to time when markets do what they do — fluctuate.

How To Make Money Trading Call Options

The basics of stock options trading are to first, choose the stock that you wish to use as your underlying asset. Then you will need to do your research and decide if you think the stock price will rise or fall. And then look at the available option quotes, which will give you a choice of combinations for strike prices, termination dates, and premiums. There are some options strategies that are especially terrific for Rule 1 investors, such as the collar, where you buy a put and sell a call — a strategy that limits your risk if the stock price falls, while still letting you benefit if the stock price rises.

You can see, then, that unless the company goes out of business or doesn't perform well, offering stock options is a good way to motivate workers to accept jobs and stay on. Those stock options promise potential cash or stock in addition to salary.

5 options trading strategies for beginners

Let's look at a real world example to help you understand how this might work. The employees can exercise the options starting Aug. On Aug. Here are the choices for the employee:. Whatever choice an employee makes, though, the options have to be converted to stock, which brings us to another aspect of stock options: the vesting period. In the example with Company X, employees could exercise their options and buy all shares at once if they wanted to.

Usually, though, a company will spread out the vesting period, maybe over three or five or 10 years, and let employees buy so many shares according to a schedule. Here's how that might work:.

And each year you're going to hope the stock price continues to rise. If you don't exercise the options within that period, you lose them. And if you are leaving a company, you can only exercise your vested options; you will lose any future vesting. One question you might have is: How does a privately held company establish a market and grant strike price on each share of its stock?

This might be especially interesting to know if you are or might be working for a small, privately held company that offers stock options. What the company does is to fix a price that is related to the internal value of the share, and this is established by the company's board of directors through a vote. Overall, you can see that stock options do have risk, and they are not always better than cash compensation if the company is not successful, but they are becoming a built-in feature in many industries.

Personal Finance. Financial Planning. How do stock options work? Stock options allow employees to reap the benefits of their company's growth. See more investing pictures.