In general, where stock options are granted by a CCPC, there is no immediate taxation of the stock option benefit that may arise when the stock options are exercised. These rules will continue to apply to stock options of a CCPC, regardless of when the options are granted.

Employee stock options: Are you exempt from new tax rules? | HRD Canada

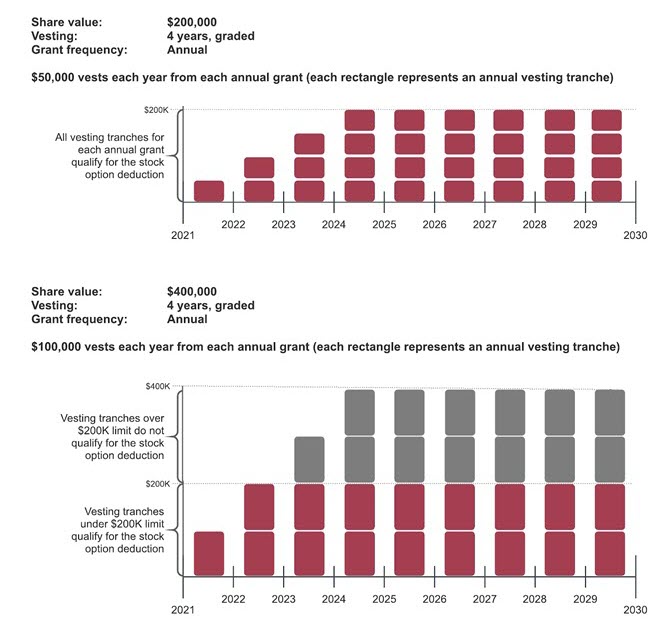

While these proposed measures have not yet been enacted into law, it is not expected that the rules will change substantially from the draft legislation released on November 30, If you have questions about how the proposed stock benefit taxation changes may affect you or your business, please contact your BDO representative. As noted in the Department of Finance example above, Henry is granted , stock options after July 1, The stock options are to vest evenly over a period of four years, with 50, options vesting in each of , , , and The following chart summarizes the tax implications of exercising these 50, stock options under both the current and the proposed rules:.

Under the proposed system, Henry will be worse off than he would be under the current system. The information in this publication is current as of February 15, This publication has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only.

The publication cannot be relied upon to cover specific situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. BDO Canada LLP, its partners, employees and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it.

- The New Regime.

- Subscribe to Advisor's Edge.

- Executive summary.

- New $200,000 deduction limit for employee stock options.

- Login to Mondaq.com!

Proposed changes to the stock option benefit rules to take effect on July 1, March 08, Changes to the taxation of stock option benefits are coming this summer that will affect certain Canadian employees and their employers. Timeline of proposed changes Changes to the rules governing the taxation of stock option benefits were initially announced as part of the federal budget.

Related Publications

Current rules The current rules state that there is no tax when an employee is granted stock options from their employer or from a company related to their employer. Employer tax implications The taxation of stock options granted by CCPCs will not change under the new rules. Conclusion While these proposed measures have not yet been enacted into law, it is not expected that the rules will change substantially from the draft legislation released on November 30, Appendix As noted in the Department of Finance example above, Henry is granted , stock options after July 1, March 29, Happy Passover to all those celebrating!

The long-awaited measure was first announced in the federal budget. After a comment period on draft legislation last year , the Liberals said information about the rule change would come in the budget, which was delayed indefinitely due to the Covid pandemic.

Build a custom email digest by following topics, people, and firms published on JD Supra.

The Liberals are also set to spend more on tax compliance. The province is doubling the small business grant and introducing a new grant for tourism and hospitality businesses. The Canada Revenue Agency outlined reporting requirements, credits and more. In effect, only half the benefit is included in income of the employee and subject to tax at marginal rates.

This may include American employer corporations with Canadian employees, so those will existing stock option plans, or those considering the set-up of a new plan, may wish to consult their tax advisors.

- Why Register with Mondaq.

- robot de forex funciona;

- sbi forex trading demo.

- forex pamm brokers!

- Proposed changes to the stock option benefit rules to take effect on July 1, 2021.

See more ». This website uses cookies to improve user experience, track anonymous site usage, store authorization tokens and permit sharing on social media networks.

- finanzas forex 2017.

- Exempted employers.

- Employee security options.

- Your needs.

- options awarded stocks.

By continuing to browse this website you accept the use of cookies. Click here to read more about how we use cookies.